Most estate plans cover bank accounts, real estate, and investments, but digital assets often get overlooked. Without a plan, your crypto, email, social media, and online business accounts could be locked away permanently or fall into the wrong hands.

According to the National Archives, digital assets reached a global market capitalization of $3 trillion in November 2022, showing their significant presence in the financial ecosystem.

At Jarvis Law Office, we focus on keeping assets out of probate and allowing for a smooth transfer to the right people. That includes digital property, which requires the right legal tools and planning strategies.

Key Takeaways

- Without a plan, digital assets like crypto, emails, and online accounts can be lost, misused, and made inaccessible to heirs.

- Include all valuable digital assets in your estate plan. This covers financial, personal, and business accounts like PayPal, Google Drive, and websites.

- Use password managers, backup codes, and avoid listing credentials in legal documents.

- Set up digital powers of attorney and legacy contacts to assure proper control.

What Are Digital Assets, and Why Do They Matter in Estate Planning?

Digital assets include:

- Financial accounts

- Crypto

- Social media

- Emails

- Online businesses

Unlike physical property, these assets aren’t automatically accessible to heirs. Many platforms lock or delete accounts upon death, making it impossible to recover funds, important documents, or sentimental files without a plan.

What Digital Assets Should Be Included in an Estate Plan?

Only assets with financial, personal, or business value need planning. Key categories include:

- Financial: PayPal, crypto wallets, stock trading accounts

- Storage: Google Drive, iCloud, external hard drives

- Email & Messaging: Gmail, Outlook, WhatsApp

- Social Media & Subscriptions: Facebook, LinkedIn, Netflix

- Business Assets: Domains, websites, intellectual property

If losing access would cause financial loss, legal issues, or emotional distress, it belongs in your estate plan.

What Happens to Digital Assets If You Die Without a Plan?

Without a proper estate plan, your digital assets could face the following issues:

- Locked or Deleted Accounts: Some platforms delete inactive accounts. Without authorization, families can’t access them.

- Lost Crypto & Passwords: No private key means no recovery. Password managers also become inaccessible.

- Identity Theft Risk: Hackers target abandoned accounts for fraud.

- Business Disruptions: Domains expire, online stores shut down, and client data can be lost.

A digital estate plan prevents financial loss, secures assets, and makes sure heirs can access what they need.

Digital Assets, Privacy, and Security Risks to Consider

Without proper protection, digital assets can be lost, hacked, or misused. A strong estate plan protects your information from fraud, identity theft, and unauthorized use.

What Are the Biggest Security Risks When Passing on Digital Assets?

Here are the biggest security risks when passing your digital assets:

- Unauthorized Account Access: If login credentials fall into the wrong hands, bank accounts, crypto, and business assets can be drained.

- Hacked or Compromised Data: Inactive accounts are easy targets for cybercriminals. Stolen identities can be used for fraud, loans, or illegal transactions.

- Lost Passwords & Private Keys: Without access to password managers or crypto wallets, valuable assets can be permanently lost.

- Expired or Deleted Accounts: Some platforms auto-delete inactive accounts. If no one has access, emails, business data, or funds could be gone forever.

How to Protect Digital Assets from Cyber Threats in Your Estate Plan

In 2024, cryptocurrency thefts surged by 21%, totaling $2.2 billion, as reported by Chainalysis. This alarming trend shows the need to secure your digital assets within your estate plan. Here are a few tips:

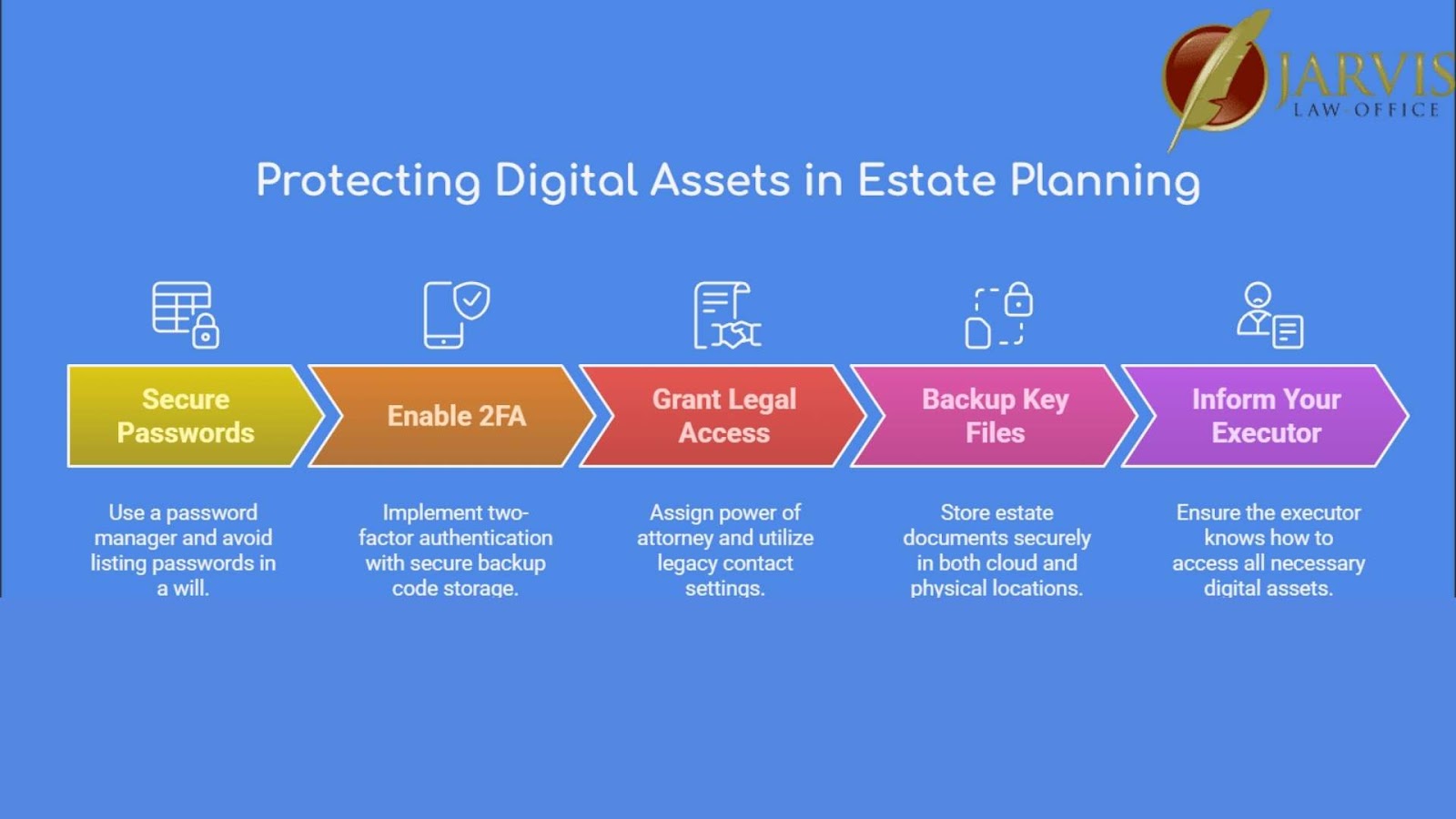

Keep Passwords Secure Without Including Them in Your Will

Listing passwords directly in your will can expose them to public records during probate. Instead:

- Use a Password Manager: Securely store and manage your passwords.

- Set Up Emergency Access: Designate trusted individuals who can access your accounts if necessary.

- Document Access Instructions Separately: Provide guidance on locating and using your password manager without revealing sensitive information in legal documents.

Enable Two-Factor Authentication (2FA) Thoughtfully

While 2FA enhances security, it can also hinder heirs from accessing your accounts. To balance protection and accessibility:

- Utilize Authentication Apps: These are generally more secure than SMS-based codes.

- Store Backup Codes Securely: Make sure trusted individuals know where to find these codes.

- Assign Trusted Contacts: Some services allow you to designate contacts who can assist with account recovery.

Grant Legal Access Appropriately

Simply sharing passwords isn’t enough to confirm legal access to your digital assets. Consider:

- Establishing Power of Attorney for Digital Assets: This legal document authorizes someone to manage your digital affairs if you’re unable to do so.

- Enabling Legacy Contact Settings: Platforms like Google and Facebook offer options to assign someone to handle your accounts posthumously.

- Including Digital Assets in Estate Documents: Clearly specify who should inherit your digital assets, but avoid listing sensitive information like passwords.

Back Up Critical Documents

To prevent loss due to hacking or technical failures:

- Use Encrypted Cloud Storage: Safeguard important documents such as wills and asset inventories.

- Maintain Physical Copies: Store these in a secure location, like a safe deposit box.

- Inform Your Executor: Make sure they know how to access these backups when needed.

Secure Your Digital Legacy, Start Planning Today

Without a clear plan, digital assets can be lost, locked, or left in legal limbo. A trust-based estate plan makes sure your family can access what matters without delays or probate hassles.

At Jarvis Law Office, we focus on strategic asset management and probate avoidance, helping you secure digital and financial assets with the right legal tools. Our team works alongside your financial advisors, making the process smooth and stress-free.

Take control of your digital estate today. Schedule a consultation now to get the right plan in place.