If you’re an Ohio resident wondering if you’ll owe estate tax or what your family might face after you’re gone, you’re not alone. The rules can feel unclear, especially when you hear terms like estate tax, inheritance tax, and federal exemption.

According to Vorys, the federal estate tax exemption for 2025 is $13.99 million, which means most estates won’t owe federal taxes, but planning is still important.

At Jarvis Law Office, helping families plan ahead is what we do every day. We focus on avoiding probate, making sure your assets are protected, and your wishes are carried out efficiently.

Key Takeaways

- Ohio doesn’t have an estate tax or inheritance tax as of 2025.

- Federal estate tax only applies to estates over $13.99 million.

- You can reduce or avoid estate taxes through gifting, trusts, and smart planning.

- Inheriting retirement accounts may lead to income tax, even if estate tax doesn’t apply.

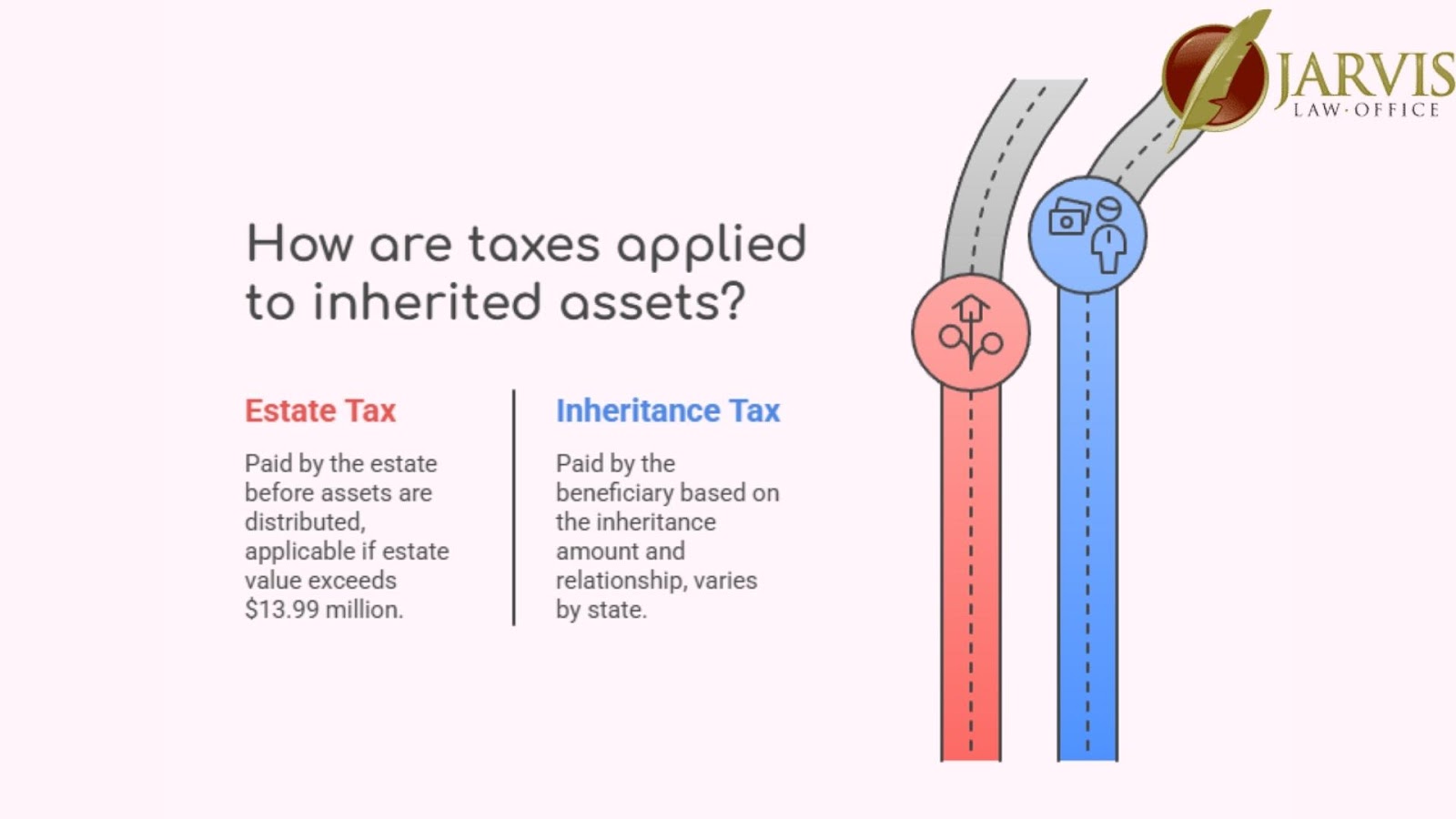

What’s the Difference Between Estate Tax and Inheritance Tax?

Estate tax is paid by the estate before assets go to heirs. Inheritance tax is paid by the person receiving the inheritance.

Estate tax: Paid by the estate

If someone dies with assets over a certain amount, the estate may owe taxes before anything is passed on. In 2025, the federal estate tax applies only if the estate is worth more than $13.99 million.

Inheritance tax: Paid by the beneficiary

This tax is based on how much you inherit and your relationship to the deceased. If you inherit from someone in a state that does have an inheritance tax, you might still owe.

Does Ohio Have Estate or Inheritance Tax in 2025?

No. Ohio doesn’t have an estate tax or an inheritance tax.

Ohio repealed its estate tax in 2013. Before that, estates over $338,333 were taxed, but that rule no longer applies. As of 2025, no matter how much an estate is worth, Ohio won’t tax it.

The same goes for inheritance tax. If you inherit money or property from someone who lived in Ohio, you won’t owe the state anything.

But if you inherit from someone in a state that still has an inheritance tax, like Pennsylvania or Iowa, you might still owe tax to that state, even if you live in Ohio.

That depends on:

- Where the person who passed away lived

- Where the assets are located

- That state’s inheritance tax rules

If you’re not sure, check that state’s laws or ask a probate attorney.

How Does the Federal Estate Tax Work in 2025?

The federal estate tax only applies if someone dies with an estate worth more than $13.99 million in 2025. If the estate is larger, only the portion over the exemption is taxed. For married couples, the exemption can be doubled to $27.98 million with proper planning.

The tax rate goes up to 40%, depending on how far above the exemption the estate is. It’s not a flat rate, it’s progressive, like income tax.

Here’s what counts toward the total estate value:

- Cash

- Real estate

- Investments

- Business ownership

- Life insurance (if the estate is listed as the policy owner)

Less than 1% of estates in the U.S. are large enough to trigger it. But if your assets are close to the limit, estate planning becomes important.

What Steps Can I Take to Avoid Estate Taxes and Leave More to My Family?

Even if most estates won’t owe federal tax, planning now can help you avoid surprises and make sure more of your money goes to your family, not the IRS.

Here are smart, legal ways to reduce or avoid estate taxes:

- Use the annual gift exclusion

You can give up to $19,000 per person per year (2025 limit) without triggering gift tax. Over time, this reduces the size of your estate. - Set up a trust

Trusts can move assets out of your taxable estate and help avoid probate. Options include revocable living trusts, irrevocable trusts, and special-purpose trusts. - Use your full exemption wisely

If you’re married, work with an estate planner to double your exemption, up to $27.98 million, with strategies like portability or credit shelter trusts. - Make charitable gifts

Donations to qualified charities reduce your estate’s taxable value and can support causes you care about. - Update your plan regularly

Tax laws change. What works today might not work in a few years. Review your estate plan every few years, or after big life events.

Do I Have to Pay Taxes If I Inherit an IRA, 401(k), or Home?

Inheriting assets doesn’t always mean estate tax, but it can trigger income tax, depending on what you receive.

Retirement accounts like IRAs or 401(k)

These accounts are often tax-deferred, which means the money hasn’t been taxed yet. If you inherit one, you’ll likely owe income tax when you take money out.

For most non-spouse beneficiaries, you have to withdraw the full amount within 10 years of inheriting it, under the SECURE Act rules. Spouses have more flexibility.

Inherited homes or real estate

You usually get a step-up in basis, which means the property’s value resets to what it was worth when the person died. If you sell right away, you may owe little or no capital gains tax.

Cash or other assets

In most cases, you won’t owe tax on the inheritance itself, unless it’s from a state that charges inheritance tax.

Are Estate Tax Laws Changing After 2025?

Yes, unless Congress acts, the federal estate tax exemption will drop in 2026.

Right now, the exemption is $13.99 million per person. But that amount comes from a 2017 tax law set to expire. As explained by Ohio State University, the federal exemption will drop to around $7 million in 2026 due to the sunset of the 2017 tax law. That shift could pull many more families into the taxable range, making 2025 a key year to act.

This change could affect:

- Families with growing investments or property

- Small business owners

- People who weren’t taxable before, but now might be

If your estate could come close to the lower limit in a few years, it’s smart to plan now. Gifting, trusts, and other tools can help you lock in today’s higher exemption before it shrinks.

Want to Keep More in Your Family’s Hands, and Out of Probate?

If you’re ready to protect your assets, avoid unnecessary taxes, and keep things simple for your loved ones, Jarvis Law Office is here to help. Our team focuses on strategic estate planning and probate avoidance, with practical tools like trust-based asset transfers and one-time, cost-effective planning solutions.

Reach out to us directly through our contact page to schedule a conversation. Let’s make sure everything you’ve worked for stays in the right hands.