When planning your estate, one of the most important decisions you’ll make is who will manage your assets when you’re no longer around. You may have heard the terms executor and trustee, but understanding the difference is key to making sure your estate is handled the way you intend.

With $84.4 trillion in wealth expected to transfer between generations by 2045, according to Cerulli Associates, choosing the right executor or trustee is more important than ever. Proper planning confirms that assets pass smoothly without unnecessary legal battles or delays.

At Jarvis Law Office, we help families avoid probate by guiding them through strategic asset management. Instead of letting the courts decide how assets are distributed, we make sure everything is placed into trusts efficiently, keeping your existing financial advisors involved.

Key Takeaways

- Executors and trustees serve different purposes. Executors handle the estate through probate, while trustees manage trust assets over time.

- Choosing the right person is important to avoid delays, disputes, and mismanagement.

- Many estate plans require both roles to cover all assets, making for a smoother process.

- Without proper planning, courts may appoint someone for you, potentially against your wishes.

What Is the Difference Between an Executor and a Trustee?

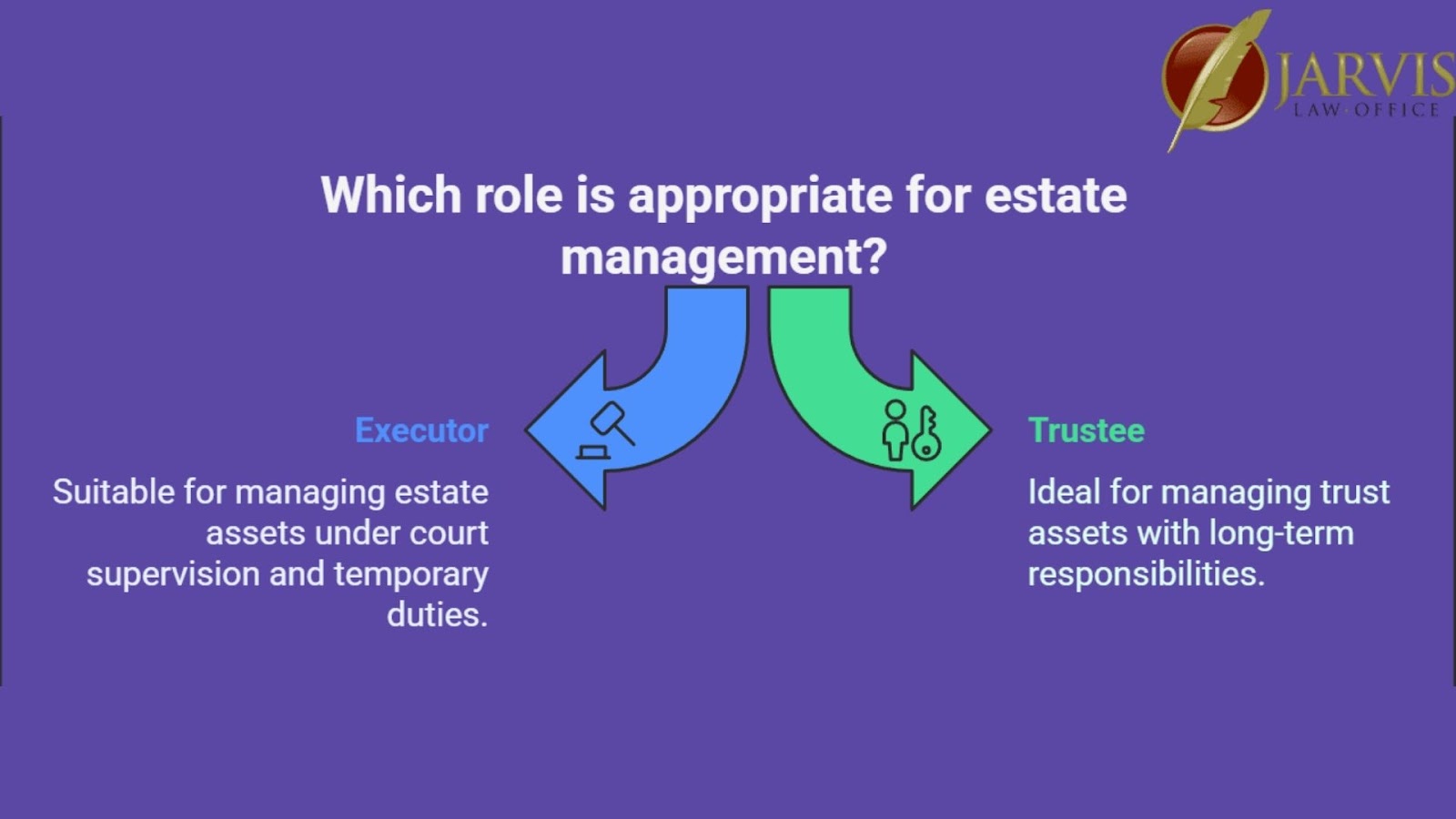

An executor is responsible for managing a person’s estate after they die. They verify that the will is followed, debts are paid, and assets are distributed through probate. A trustee manages assets placed in a trust, following its terms to distribute funds to beneficiaries, often without court involvement.

The executor’s role is temporary, ending when the estate is settled, while a trustee’s role can last for years.

Here are the key differences between them in terms of responsibilities and scope of authority:

Appointment and Authority

- Executor: Appointed through a will to administer the decedent’s estate, operating under the supervision of the probate court.

- Trustee: Designated in a trust document to manage trust assets, typically without court oversight.

Scope of Responsibilities

- Executor: Manages all assets within the decedent’s estate, including those not placed in a trust, as well as paying debts, and distributing assets as per the will.

- Trustee: Oversees only the assets held within the trust, managing and distributing them according to the trust’s terms.

Duration of Role

- Executor: Serves temporarily, concluding duties once the estate is settled and assets are distributed.

- Trustee: May serve for an extended period, potentially spanning years or decades, depending on the trust’s terms and objectives.

What Does an Executor Do?

An executor carries out the instructions in a will after someone dies. Their main job is to settle the estate, which includes:

- Filing the will with the probate court (if required).

- Notifying beneficiaries and creditors.

- Gathering and managing the deceased’s assets.

- Paying outstanding debts, taxes, and expenses.

- Distributing the remaining assets to beneficiaries.

The executor’s job ends once the estate is fully settled. This role is particularly important given that about 66% of Americans do not have a will or living trust, as reported by Caring. Without a will, state law determines how assets are distributed, which can make the executor’s job even more challenging.

How Do You Choose the Right Executor?

Choosing an executor requires selecting someone who is responsible, organized, and impartial. The majority of Americans choose a family member as their executor, with spouses and adult children being the most common choices. However, selecting someone simply because they are family can lead to conflicts, particularly if they lack financial or legal knowledge.

Executors must also be prepared for potential legal complications. While it is rare for a will to be formally contested, disputes can be costly.

What Happens If There Is No Executor?

If no executor is named in the will or the chosen executor cannot serve, the probate court appoints an administrator, usually the closest living relative.

This person has the same duties as an executor but must follow court guidelines. If no suitable family member is available, the court may appoint a public administrator or professional fiduciary to handle the estate.

What Does a Trustee Do?

A trustee manages assets placed in a trust according to the trust’s terms, and makes sure that they benefit the designated beneficiaries. Their responsibilities include:

- Administering the trust: Overseeing and managing the assets held within the trust.

- Fiduciary duties: Acting in the best interest of the beneficiaries, maintaining loyalty, prudence, and impartiality.

- Distributing assets: Allocating income or principal to beneficiaries as specified in the trust document.

- Recordkeeping and reporting: Keeping detailed records of all transactions and providing regular updates to beneficiaries.

- Tax filings: Preparing and filing necessary tax returns related to the trust.

Unlike an executor, whose role ends after settling an estate, a trustee’s duties can continue for many years, depending on the trust’s terms.

What Are the Different Types of Trustees?

Trustees can be categorized based on their roles and the nature of the trust they manage. Common types include:

- Individual Trustees: These are personal acquaintances, such as family members or close friends, chosen for their familiarity and trustworthiness.

- Professional Trustees: These are entities like banks or trust companies that offer fiduciary services for a fee, bringing professional knwoledge to trust management.

- Family Trustees: Family members appointed to oversee trusts that make sure assets are managed in line with family interests.

- Corporate Trustees: Organizations appointed to manage trusts, providing professional management and continuity, especially beneficial for complicated or long-term trusts.

Do You Need an Executor, a Trustee, or Both?

Understanding when you need an executor, a trustee, or both depends on your estate planning goals. Many people require both roles, especially when combining a will with a trust.

When You Need an Executor

- You Have a Will: An executor is necessary to administer and settle your estate as outlined in your will.

- Probate Is Required: If your estate includes assets that don’t automatically transfer to beneficiaries, an executor will guide the probate process to allow for legal compliance.

When You Need a Trustee

- You Have a Trust: A trustee manages assets placed in a trust, overseeing their distribution according to your specified terms.

- Ongoing Asset Management: If you wish to provide for beneficiaries over an extended period, such as minors or individuals with special needs, a trustee can manage and distribute assets accordingly.

When You Need Both

- Comprehensive Estate Plan: Many individuals establish both a will and a trust. In such cases, an executor handles assets governed by the will, while a trustee manages those within the trust.

How to Choose the Right Executor or Trustee for Your Estate

Selecting the appropriate executor or trustee is important for your estate. Here are key factors to consider:

1. Trustworthiness and Integrity

Choose someone reliable and honest, as they will handle your assets and personal matters.

2. Financial and Legal Acumen

While experience in finance or law isn’t mandatory, the individual should possess basic financial literacy and the ability to seek professional advice when necessary.

3. Organizational Skills

The role requires meticulous record-keeping and attention to detail. An organized individual can efficiently manage tasks such as asset inventory, bill payments, and tax filings.

4. Impartiality

Select someone who can remain unbiased, especially if family dynamics are complicated, to prevent potential conflicts among beneficiaries.

5. Availability and Willingness

The person should be willing to accept the responsibility and has the time to dedicate to the role, as it can be time-consuming.

6. Proximity

While not required, having an executor or trustee who lives nearby can more easily facilitate the management of local assets and coordination with professionals.

7. Age and Health

Appoint someone likely to outlive you and remain capable of performing their duties, considering the potential long-term nature of trust management.

8. Professional vs. Individual

Decide between a personal acquaintance or a professional entity (like a bank or law firm). Professionals offer skill and neutrality but charge fees, whereas known individuals may be more familiar with your personal wishes.

9. Successor Planning

Name alternate executors or trustees in case your primary choice is unable or unwilling to serve when the time comes.

10. Communication Skills

The ability to communicate effectively with beneficiaries and professionals is important for transparency and managing expectations.

Frequently Asked Questions About Executors and Trustees

Q: Do executors and trustees get paid?

Yes. Executors typically receive 2–5% of the estate’s value, while trustees may charge a flat fee or annual management percentage.

Q: What happens if an executor or trustee resigns?

If an executor or trustee resigns, a successor named in the will or trust takes over; otherwise, the court appoints a replacement.

Q: Can a beneficiary remove an executor or trustee?

Yes, beneficiaries can petition the court for removal due to misconduct, incompetence, or failure to act in the estate’s or trust’s best interests.

Q: Are executors and trustees personally liable for mistakes?

They can be held personally liable for breaching fiduciary duties but are generally protected when acting in good faith.

Make Sure Your Estate is Handled the Right Way

Choosing the right executor or trustee is one of the most important steps in protecting your assets and offering a smooth transition for your loved ones. The right choice can avoid probate, reduce costs, and keep your estate in trusted hands.

At Jarvis Law Office, we keep your assets out of court and under the management of the people you trust. Our one-time fee option provides a cost-effective solution, making sure your estate is set up properly without ongoing expenses.

Want to make sure your estate is structured the right way? Contact us today to get personalized guidance from our experienced team.