written by Marketing Manager Jonathan Corra

I think it’s safe to say there’s no easy part of losing a parent. But it’s even harder when it happens at a young age. I was 13 when my dad was diagnosed with brain cancer, and just 15 when he passed away. We had two tough years filled with highs and lows, and although I was still a teen, I felt like an adult by the end of it.

Gone was the patriarch of our family. My dad left behind me, my sister, and my mom, and we were lost, to say the least. He was only 42. My mom was just 39. We had no idea what we were doing. It was 1999, and the internet wasn’t what it is today. There was a lot of misinformation out there, and unfortunately, my mom trusted advice that turned out to be wrong. One piece of bad information led to the sale of my dad’s truck. And now, more than 26 years later, I know there was a way we could’ve protected that important piece of our family history.

Growing Up Corra: Hair, Height, and Horsepower

Growing up a Corra meant a few things. One, nobody could pronounce your last name. Two, you were probably tall with dark hair. And three, you’d better love vehicles. I joke that the only reason I exist is because my dad owned a 1978 Pontiac Trans Am. It’s no joke, though. My mom had to choose between my dad and another guy. My dad had the cooler car, and she chose him. That story actually made it into her eulogy.

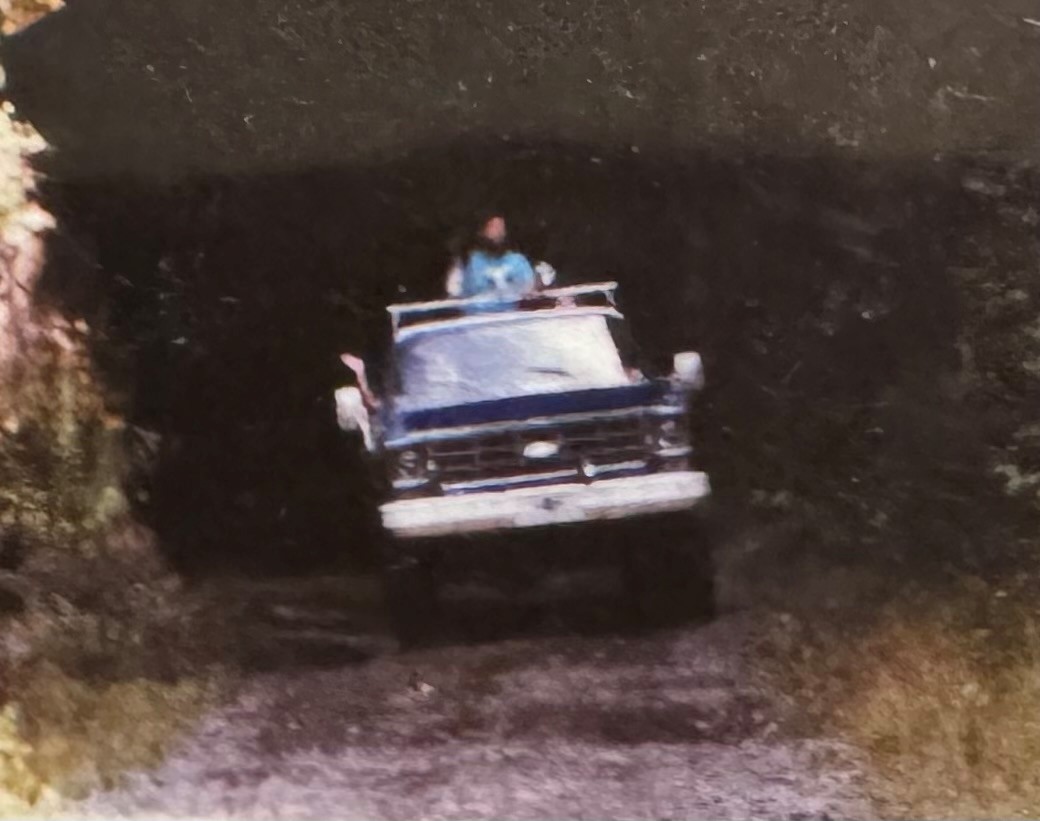

My parents struggled financially for years after getting married. The 1980s economy didn’t help. But by the end of the decade, things were looking up. My dad landed a good job and rewarded himself with a used 1978 Chevrolet K Series, better known as a square body. It was beautiful: blue with a white roof. He added a lift kit and occasionally took it off-roading. That truck towed our camper and carried us on countless adventures. He loved that truck.

He didn’t exactly baby it, though. By the time he passed, the truck wasn’t in the best shape. It became our third vehicle and mostly stayed on the property. Still, it held a lot of great memories.

A Decision My Mom Regretted

Shortly after my dad passed away, my mom sold that truck. Someone told her it was the smart thing to do, to help make ends meet without his income. Later, she told my sister and me she regretted it. At the time, we didn’t know better. We were just trying to survive.

Fast forward to last week at the Good Guys Car Show. I waited until Sunday to walk the show and check out the cars. The first one that caught my eye was a Trans Am, a reminder of why I’m even here. Then I saw it: a gorgeous square-body Chevy. This one had been a fire truck, fully restored and absolutely beautiful. It brought back a flood of memories of my dad and the good times we had with his truck.

I didn’t cry. Years of therapy have helped with that. But I’d be lying if I said it didn’t hit me hard.

What Could’ve Saved That Truck? A Trust.

As I walked back to our booth, I remembered why we were there: to promote car trusts. And in that moment, I realized something painful. If my dad had set up a trust, we might still have his truck today.

While I can’t get his Chevy back, I can share what I’ve learned so other families don’t lose something so meaningful. Let’s take a look at how you can protect your vehicles and your legacy.

What’s Threatening Your Classic Car?

The Problem with Probate

At the show, several people told me, “I’m good. I put my car in my will.” While a will is better than nothing, it’s far from bulletproof. A will still has to go through probate, and probate costs your family in three major ways:

- Time: Probate takes 12 to 18 months on average. That delay can drag out an already painful grieving process.

- Money: Probate fees usually eat up 5–7% of your estate. If your estate is worth $300,000, that’s $15,000 gone, mostly to attorneys. And if your collector car is worth $100,000, expect at least $5,000 of that to disappear.

- Public exposure: Wills are public once they go through probate. That means your plans can be contested. Imagine this, you’ve got a 1968 Dodge Charger you’ve left to your favorite son, Jesse. But your other son, Bo, has a different idea… or worse, his wife Daisy wants that Charger. If they challenge the will, they might just win.

Long-Term Care: The Other Predator

Long-term care isn’t cheap. In Central Ohio, you’re looking at $10,000–$15,000 per month. Even with $300,000 saved, your money could vanish in just a couple of years.

That’s where Medicaid steps in, but only after you’re broke. If your spouse is still living, they can stay in the home and keep one vehicle. Just one. So if your classic is the second vehicle, it has to go. Your beloved car may have to be sold just to qualify for care.

Why Gifting Isn’t the Answer

Some people try to outsmart the system by giving the car to a family member, hoping it avoids Medicaid rules. But that’s risky. First, there’s a five-year Medicaid lookback period, so gifting it now doesn’t mean you’re in the clear. Second, once it’s in someone else’s name, it’s legally theirs.

Let’s say you transfer your car to Bo (you know… Jesse’s less responsible brother). Years go by. Then one night, Bo gets behind the wheel after a few too many at the Boar’s Nest, crashes, and gets sued. The court could seize your Charger—because legally, it’s his.

The Solution: A Trust for Your Car

A trust can protect your classic car from all these threats, probate, Medicaid, lawsuits, divorce, and more. It’s a powerful tool for passing on your legacy the right way.

Let’s say you’ve got a beauty in the garage. Maybe a ’67 Mustang, a ’55 Bel Air, or a souped-up GTO. You don’t want it to get tied up in court, taxed, or sold off. A trust solves that. It holds your car and includes instructions for who gets it, when, and under what conditions. You choose a trustee to carry out your wishes and ensure it lands in the right hands.

For example, if you’ve got a grandson who’s always helped you in the garage, you can specify that he gets the car when he turns 25, and that he can’t sell it for five years. You stay in control even when you’re no longer around.

More than control, a trust gives you protection. It shields your vehicle from being counted against you for Medicaid. It keeps it out of court. It keeps it from being taken in a lawsuit. And most importantly, it keeps it in the family.

Don’t Take Your Classic to Walmart

When it comes to protecting your car, you don’t want a generic estate plan from a lawyer who dabbles in everything from family law to fender benders. That’s like taking your ’67 Yenko Camaro to Walmart for an oil change. Sure, they can do it…but do you really want them to?

At Jarvis Law Office, we focus only on estate planning and elder law. No cookie-cutter plans here. We tailor each plan to your life, your legacy, and yes, your car collection. Just last month, we worked with a woman who owned 28 cars. Her plan looked very different from someone with one home, no kids, and a Corolla.

No one wants to see spinner wheels on a GTO. And no one should settle for a one-size-fits-all plan.

Your Next Step

✅ Call us for a FREE 15-minute Discovery Call.

✅ Click here to schedule your appointment online—it only takes a few minutes.

✅ Better yet, come see us at one of our free workshops. Show off your ride and learn how to protect it while you’re at it. Check out our full schedule here.

Cars mean a lot to me and my family. I wish I still had my dad’s old square-body Chevy or the Trans Am that started it all. I can’t get them back. But you can learn from my family’s mistakes. Protect your legacy today, so your car doesn’t become just another “one that got away.”