When someone loses the ability to make decisions, due to illness, injury, or age, things can get complicated fast. Bills go unpaid. Medical choices stall. Families are left guessing. That’s why incapacity planning matters.

Yet, according to AARP, only one-third of Americans 55 and older have designated a health care power of attorney. That means most families are completely unprepared when something happens.

At Jarvis Law Office, we help Ohio families avoid the chaos that comes with not having a plan in place. We believe that anyone over the age of 18 should have foundation documents such as a financial power of attorney, healthcare power of attorney, living will and HIPAA. Once you turn 18, no one has the ability to legally make decisions for you, not even your spouse. As you age, and incapacity due to age-related ailments becomes more likely, there are additional tools that help safeguard your assets in the event of incapacity while making it smooth and easy for your family to step in. Our team focuses on transferring assets properly, using trusts and smart legal tools that work when they’re needed. We also make sure you can keep working with your financial advisor, so your plan fits with everything you’ve already built.

Key Takeaways

- Incapacity planning lets others act for you if needed.

- Key documents include power of attorney and health directives.

- Everyone 18+ should have a plan.

- Choose trusted people and review your plan over time.

What Is Incapacity Planning?

Incapacity planning means setting up legal tools so someone you trust can manage your finances, health care, and daily affairs if you can’t.

Without a plan, your family may need court approval just to help you. That takes time, costs money, and adds stress during an emergency. With a plan, you stay in control by choosing who will act for you and how.

Is Incapacity Planning the Same as Estate Planning?

No. Estate planning handles what happens after you die. Incapacity planning covers what happens if you’re alive but can’t make decisions.

Who Needs Incapacity Planning

Everyone 18 or older.

No matter if you’re a parent, adult child, or single professional, you’ll want someone you trust to step in legally when needed. You need a plan. A common misconception is that if you are married, your spouse can legally make decisions for you, but that is not the case. Without documents in place giving them the authority, financial institutions and doctors aren’t legally required to speak or share information with them.

What Legal Documents Are Important for Incapacity Planning?

You only need a few key documents to cover your bases. These give someone the legal authority to act on your behalf if you’re unable to.

Durable Power of Attorney (POA)

A durable power of attorney, also known as a financial power of attorney, is a legal document that allows someone to make decisions on your behalf, even if you become mentally incapacitated. It remains in effect after you lose the ability to make decisions yourself.

Advance Health Care Directive (Living Will)

This document states your medical care preferences, life support, treatments, and end-of-life decisions. It helps guide doctors and loved ones when you can’t speak for yourself.

Health Care Proxy or Health Care Power of Attorney

A health care proxy, also known as a healthcare power of attorney, is a legal document that appoints someone to make medical decisions for you if you’re unable to do so. This makes sure your health care preferences are followed when you can’t communicate them yourself.

HIPAA Authorization

The HIPAA (Health Insurance Portability and Accountability Act) allows your chosen person to access your private medical records. Without it, even your spouse may be blocked.

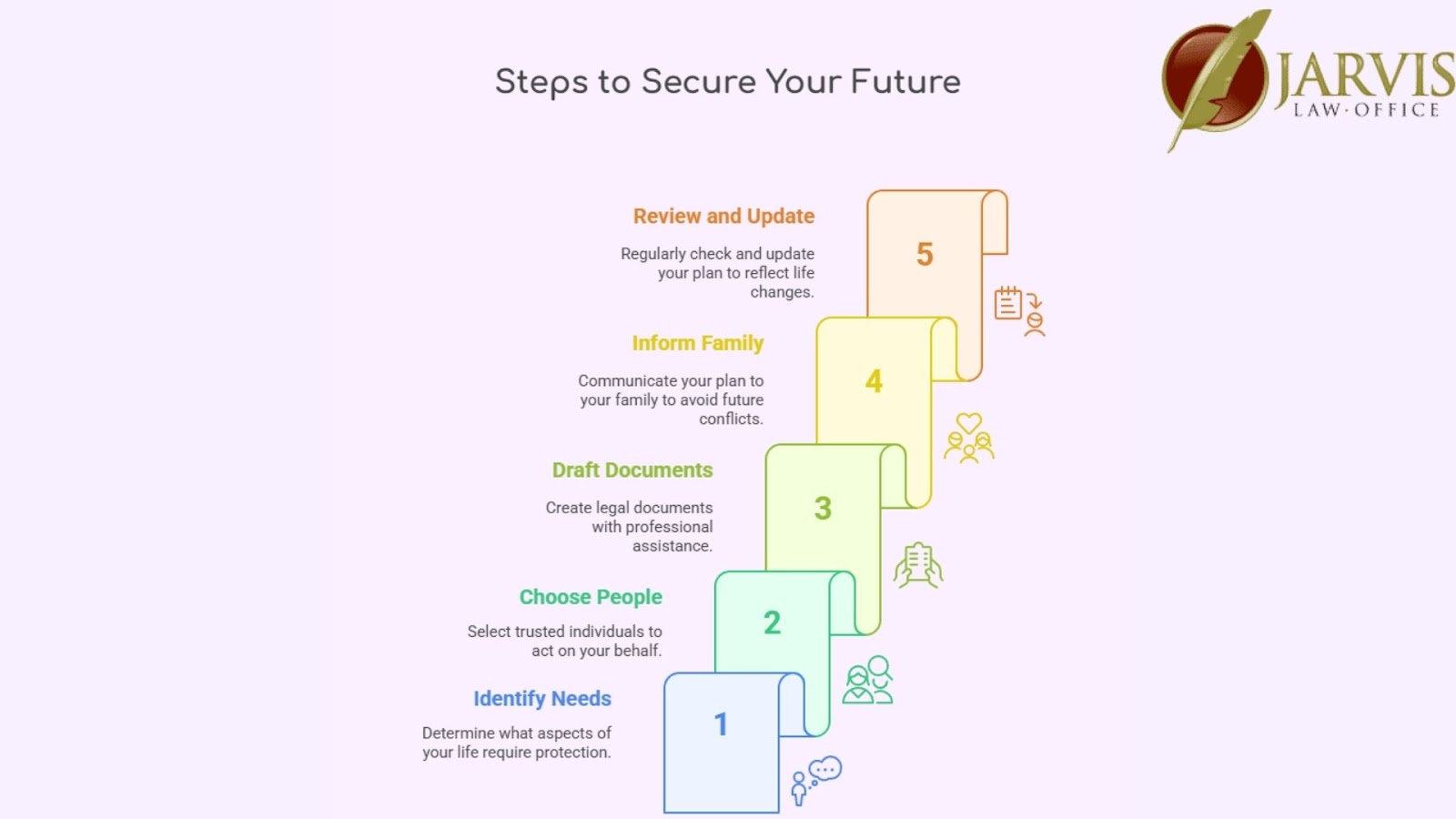

How to Create an Incapacity Plan in 5 Clear Steps

Only a small percentage of adults have everything in place. According to Forbes, just 18% of Americans over 55 have a complete set of estate planning documents, including a will, power of attorney, and health care directive.

If you want to be covered, following a few simple steps makes all the difference.

1. Identify What Needs Protection

Think about your finances, health care, children, and property. What decisions would someone need to make if you couldn’t?

2. Choose the Right People

Pick trusted individuals to act as your agent, health care proxy, or trustee. They should be responsible, available, and willing.

3. Draft the Legal Documents

Work with an attorney or use state-approved forms. Make sure everything is valid where you live and follows current laws.

4. Talk to Your Family

Tell them what your plan is, who’s in charge, and where documents are stored. This avoids confusion or conflict later.

5. Review and Update as Needed

Major life changes, marriage, divorce, death, new child may require updates. Review your plan every couple of years.

What Happens If You Don’t Plan for Incapacity?

Without a plan, the court decides who handles your affairs. That process is called guardianship or conservatorship, and it’s slow, public, and expensive. A well-known example is the Britney Spears case. For over a decade, Britney Spears lived under a court-ordered conservatorship, meaning someone else, appointed by the court, controlled her finances and personal decisions. The arrangement led to years of legal battles, significant costs, and public family conflict, demonstrating just how complicated and restrictive the process can become if you don’t have your own plan in place.

Here’s what can go wrong:

- Family conflict over who should be in charge

- Delayed decisions while waiting for court approval. With a guardianship, you have to do yearly accountancy that accounts for every penny that was spent on behalf of your loved one

- Frozen accounts and unpaid bills

- Medical choices made by someone you wouldn’t pick

- Legal fees that drain your savings

Who Should You Trust with Your Incapacity Plan?

Choose people who will act in your best interest, follow your wishes, and stay calm under pressure. As well as someone who will communicate with your family and keep your loved ones in the loop.

Pick the Right Agent or Proxy

Look for someone who is:

- Responsible and organized

- Willing to follow your instructions

- Able to make tough decisions, especially about money or health

- Available when needed (geographically and emotionally)

This can be a spouse, adult child, sibling, or close friend.

Can You Choose More Than One Person?

Yes, you can:

- Name a backup in case your first choice isn’t available

- Appoint co-agents (but this can slow things down if they disagree)

- Use different people for finances and health care

Just make sure roles are clear to avoid confusion later.

Should You Use a Lawyer?

If your situation is complicated, multiple properties, blended families, or out-of-state trustees, it’s smart to get legal help. Even for simple cases, a lawyer can make sure your documents meet state rules and can’t be challenged.

Make Sure Your Wishes Are Protected Before You Need Them

Having a plan in place means your family isn’t left scrambling. You choose who steps in, how things are handled, and what matters most to you. At Jarvis Law Office, the focus is on avoiding probate, protecting your assets, and making the process smooth, not stressful.

If you’re ready to get your plan in place or just want to ask a few questions, reach out to us here.