If you’re looking into long-term care insurance, you’re probably trying to make sure your future, or your loved one’s, is protected. The problem is that most people don’t find out what their policy doesn’t cover until it’s too late. That’s where legal planning makes all the difference.

At Jarvis Law Office, we help families avoid those surprises by making sure their assets are set up the right way before care is needed. That includes helping clients transfer property into trusts, avoid probate, and keep working with the financial advisors they already know and trust.

This guide breaks down where LTC insurance falls short, and how smart legal planning fills in the gaps. If you want to keep your home, savings, and decisions in your hands, the information ahead will help you do exactly that.

Key Takeaways

- Long-term care insurance doesn’t cover all care-related costs, especially home modifications and family caregivers.

- Policy limits and exclusions can lead to significant financial and legal challenges if unaddressed.

- Legal planning with a lawyer can protect your home, savings, and decision-making authority.

- Starting legal planning early offers more options and protects your assets before a crisis hits.

What Is Long-Term Care Insurance and What Does It Cover?

Long-term care insurance (LTCI) helps pay for care when you can no longer manage basic daily tasks on your own, things like eating, bathing, dressing, or using the bathroom.

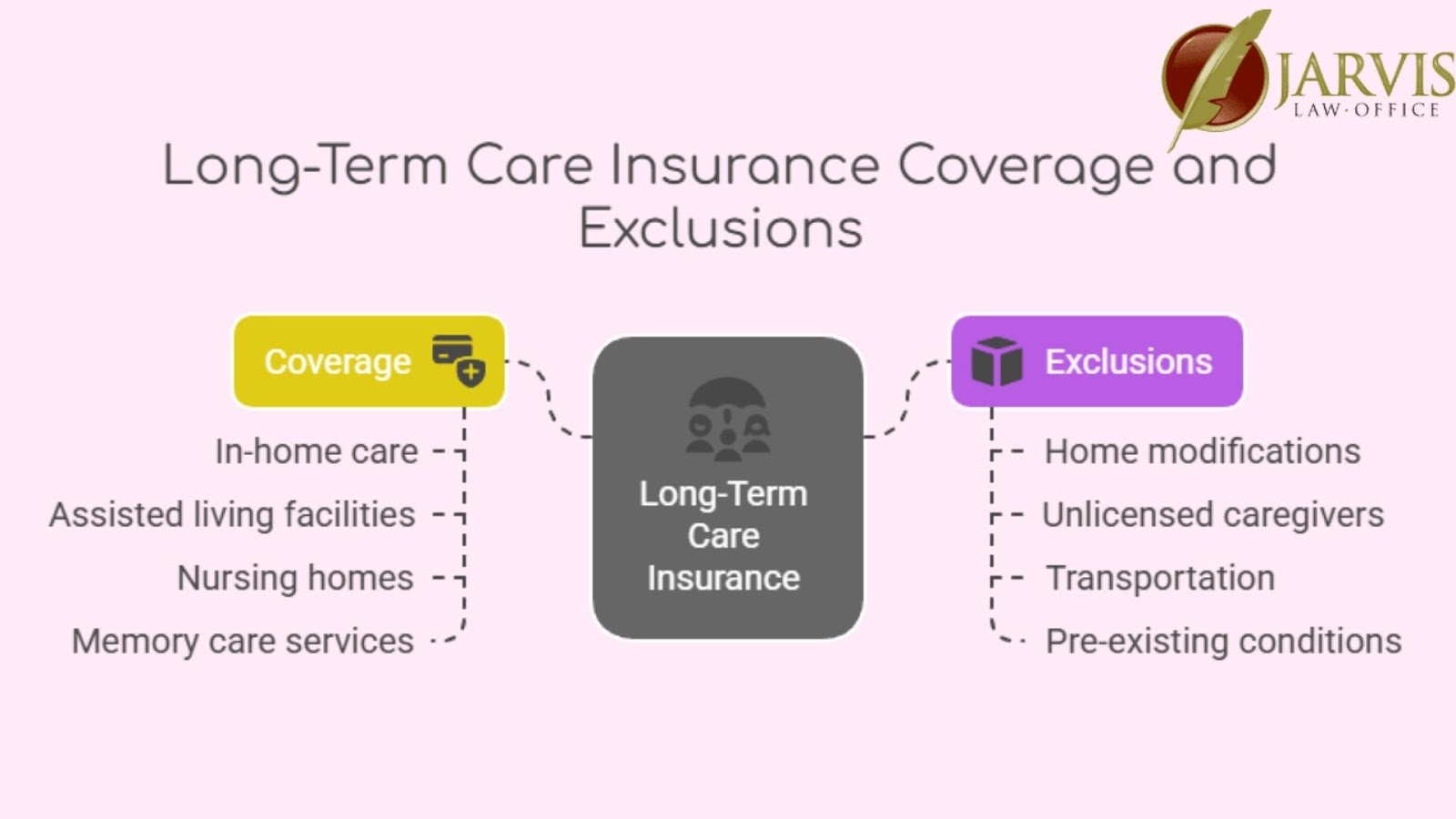

It typically covers:

- In-home care

- Assisted living facilities

- Nursing homes

- Some memory care services

Coverage kicks in only after you meet specific conditions set by the policy, such as needing help with two or more daily activities.

What Does Long-Term Care Insurance Not Cover?

Many people assume LTC insurance covers more than it does. Common exclusions include:

- Home modifications (e.g., ramps, stairlifts)

- Unlicensed or family caregivers

- Transportation to appointments

- Pre-existing conditions (depending on the policy)

Some policies delay payouts until strict benefit triggers are met, which means you could be paying out-of-pocket for months.

What Happens Legally If Your LTC Policy Is Not Enough?

Policies have payout limits. Once those are reached, you pay the rest. That could mean draining savings, selling assets, or relying on Medicaid. Though Medicaid can be a helpful asset, there are strict eligibility requirements to qualify.

If there’s no legal plan in place, families can face:

- Emergency decisions without power of attorney

- Medicaid denial due to unprotected assets

- Conflicts over who’s in charge of care or finances

- Involuntary estate loss during Medicaid recovery

A policy won’t protect your home from being claimed after you pass. It won’t decide who makes decisions if you can’t. And it won’t stop the state from stepping in if no one is legally authorized to act for you.

How a Lawyer Helps You Plan for Care Without Losing Everything

Legal professionals can implement strategies to protect your assets and facilitate Medicaid eligibility. According to Protect Our Care, approximately 70% of seniors will require long-term care, and 62% of nursing facility residents use Medicaid, making proactive legal planning essential.

Here’s what a lawyer can do that your policy can’t:

- Set up a power of attorney so someone you trust can make decisions if you can’t.

- Create trusts to protect assets from Medicaid spend-down rules.

- Review your LTC policy for gaps or confusing terms before it’s too late.

- Help you qualify for Medicaid without losing your home or retirement funds.

- Build a care plan that works with your estate plan, not against it.

When Should You Start Legal Planning for Long-Term Care?

Early planning is very important. Initiating legal preparations well before care is needed allows for more options and better protection of assets.

Here’s when to act:

- In your 50s or early 60s: Best time to set up legal documents while you’re healthy.

- If you’re caring for aging parents: You can help them protect assets before health declines.

- Before applying for Medicaid: There’s a five-year lookback period. Transfers made too late can disqualify you.

Waiting too long can mean losing choices. Planning early gives you time to protect your home, your money, and your say in how care is handled.

How to Find a Lawyer Who Works in Long-Term Care Planning

According to a Long Term Care Poll, 7 in 10 Americans will need long-term care, but only 35% of adults over 40 know this. That’s a problem because without the right legal help, most people won’t be prepared.

Insurance alone isn’t enough. You need a solid legal plan to protect your assets and make sure you get the care you want.

Look for an attorney who can:

- Explain things clearly, without legal jargon

- Review your LTC policy for risks or gaps

- Set up key documents like powers of attorney and trusts

- Help with Medicaid planning and applications

- Coordinate care planning with your financial goals

Ask these questions before hiring:

- Have you helped clients qualify for Medicaid without losing their homes?

- Do you work with clients who already have LTC insurance?

- Can you help set up trusts or other asset protection tools?

Protect More Than Just Your Policy, Start Planning with Legal Confidence

Long-term care insurance can help cover the cost of care, but it won’t protect your home, your savings, or your say in how that care is handled. That’s where legal planning comes in.

At Jarvis Law Office, we help families across Ohio set up smart, one-time legal plans that avoid probate, protect assets, and keep your existing financial relationships in place. No upsells, no hidden fees, just the tools you need to stay in control.

If you’re ready to make your long-term care plan complete, reach out to us directly here. We’ll help you take the next step with clarity and confidence.