If you’re in Ohio, it’s important to know that only 45% U.S. adults have any estate planning documents like a will, according to LegalZoom. Many more find themselves unprepared when clarity matters most.

Understanding the different types of wills is how you make sure your wishes are honored, your family is cared for, and your estate avoids unnecessary probate delays.

At Jarvis Law Office, P.C., we believe every Ohioan should understand their options without feeling overwhelmed. If your estate is simple or complicated, our team is here to guide you so that you can plan confidently.

Key Takeaways:

- A valid will in Ohio acts as instructions to the probate court on who you want to manage your estate and makes sure your assets are distributed according to your wishes.

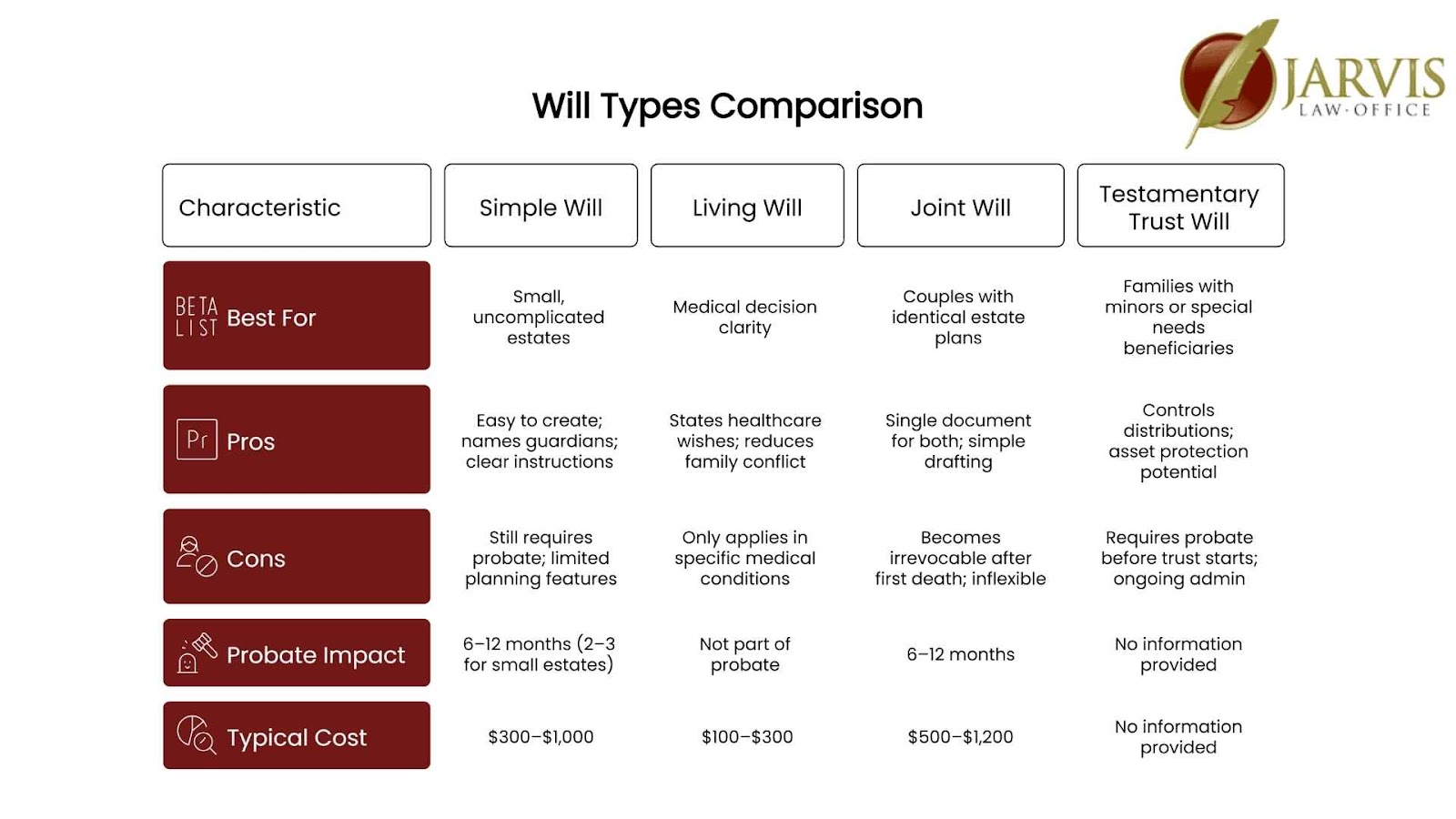

- The four main types of wills, simple, living, joint, and testamentary trust, serve different purposes, from asset distribution to healthcare directives.

- Choosing the right will depends on your estate’s intricacy, family needs, and long-term planning goals.

Why Every Ohioan Should Have a Will

In Ohio, a will is the foundation for making sure your wishes are followed.

When someone in Ohio dies without a will, their estate goes through probate under the rules of the Ohio Revised Code, meaning the state chooses your beneficiaries under the rules of intestate succession. For a typical case, probate takes 6 to 12 months to complete.

In more complicated situations, such as disputes over assets, it can stretch far longer. Even in the best-case scenario for small estates (under $35,000, or $100,000 if everything goes to a surviving spouse), the process can take 3-6 months.

There’s also the financial cost. Probate can consume 3% to 7% of the estate’s value in fees, according to MarketWatch. On a $300,000 estate, that could mean $9,000 to $21,000 lost to court costs and legal fees, money that could otherwise go to loved ones.

A clear, valid will allows for a smoother probate process. It makes sure that your assets are distributed according to your instructions, helps avoid unnecessary disputes, and can speed up the probate process for your family.

Understanding the 4 Common Types of Wills

Listed below are the most common types of will:

1. Simple Will

A simple will is the most straightforward way to outline who inherits your assets after you pass away. In Ohio, it’s best suited for people with uncomplicated estates, such as a home, a few bank accounts, and personal property, who want everything to go to a spouse, children, or other close relatives.

A valid will must be:

- In writing (typed or handwritten)

- Signed by the person making the will (the “testator”)

- Witnessed by at least two competent adults who are not beneficiaries

It’s important to understand that in Ohio, even with a simple will, your estate will still go through probate.

Pros:

- Cost-effective to draft and execute

- Clear instructions for asset distribution

- Allows you to name guardians for minor children

Cons:

- Still requires probate in Ohio

- Limited ability to handle complicated assets or tax planning

- No provisions for managing assets during incapacity

A simple will can be a good first step for many Ohioans, but it’s not one-size-fits-all. If you have significant assets, own a business, or want to protect your estate from Medicaid recovery, you may need a more advanced option, something Jarvis Law Office can walk you through.

2. Living Will

A living will is very different from the “last will and testament” that distributes your property. In Ohio, a living will is a legal document that states your wishes for medical treatment if you become permanently unconscious or terminally ill and cannot speak for yourself.

It makes sure your healthcare providers and loved ones know exactly what you want, avoiding confusion or disagreements during a crisis.

Unlike a healthcare power of attorney, which names someone to make medical decisions on your behalf, a living will speaks for you directly about life-sustaining treatments such as feeding tubes, ventilators, or resuscitation. Many Ohioans choose to have both documents so there’s no gap in their healthcare planning.

Pros:

- Clearly states your medical preferences

- Legally binding for healthcare providers in Ohio

- Reduces family conflict during difficult times

Cons:

- Only applies in cases of terminal illness or permanent unconsciousness

- Cannot cover all possible medical situations

- Must be properly executed to be valid in Ohio

For many Ohio families, adding a living will to their estate plan provides peace of mind that financial and medical wishes are equally protected. Jarvis Law Office helps clients prepare these documents alongside other will and trust options, making sure every plan is complete, clear, and ready to use.

3. Joint Will

A joint will is a single document created by two people, usually a married couple, that lays out how their assets will be distributed after both have passed away.

In Ohio, once one spouse passes away, a joint will generally becomes irrevocable. That means the surviving spouse cannot make changes, even if circumstances change, such as remarriage, the birth of grandchildren, or the need for new healthcare provisions. This rigidity can cause significant problems if the survivor’s needs evolve over time.

Ohio law still recognizes joint wills, but most estate planning attorneys recommend separate wills or a reciprocal/mirror will arrangement instead. These alternatives allow each spouse to express identical wishes while preserving the flexibility to update their own document if needed.

Pros:

- Simple to draft for couples with identical plans

- Single document instead of two separate wills

Cons:

- Becomes irrevocable after the first spouse’s death

- Cannot be updated to reflect changes in family, assets, or laws

- Still requires probate in Ohio

4. Testamentary Trust Will in Ohio

A testamentary trust will is a last will and testament that creates one or more trusts after you pass away. In Ohio, this type of will is especially valuable for families who want to control how and when beneficiaries receive their inheritance, such as providing for minor children or protecting assets for a loved one with special needs.

Under the Ohio Revised Code, the will must clearly state the terms of the trust, name a trustee, and specify how the assets will be managed and distributed. The trust only takes effect after your death, and because it’s created by a will, it still goes through probate before the trust can be funded.

Pros:

- Protection for minors: The trustee can manage assets until the child reaches the age you specify, avoiding a court-appointed guardian for funds.

- Special needs planning: Assets can be managed in a way that preserves eligibility for Medicaid or other public benefits.

- Structured distributions: Beneficiaries can receive funds over time instead of all at once, reducing the risk of rapid depletion.

Cons:

- Requires probate before the trust is activated

- Trustee must follow ongoing administrative duties and reporting requirements

- May not avoid all taxes or creditor claims

- Will increase probate costs and attorneys’ fees during the administration process

- The court may require oversight the trust for years to come

For families concerned about Medicaid’s five-year lookback or the risk of losing assets to long-term care costs, you may need a more advanced option, something Jarvis Law Office can walk you through.

What Every Will in Ohio Should Include

To be valid and effective, an Ohio will should clearly include:

- Executor designation: Names the person who will carry out your wishes.

- Beneficiaries: Identifies who inherits specific assets or portions of your estate.

- Guardianship clauses: Appoints guardians for minor children.

- Asset instructions: Details how property, accounts, and personal items are distributed.

- Witness compliance: Signed by you and two competent adult witnesses (per Ohio Revised Code 2107).

- Residuary clause: Explains what happens to any property not specifically mentioned.

Including these elements avoids confusion, reduces disputes, and speeds up probate. Even a simple estate benefits from clear, complete instructions.

Choosing the Right Will for Your Situation

The right will depends on your assets, family needs, and long-term goals:

- Simple will: Works if your estate is small, straightforward, and you want a basic plan.

- Living will: Essential if you want clear medical treatment instructions.

- Joint will: Rarely recommended due to lack of flexibility.

- Testamentary trust will: Best for protecting minors, special needs beneficiaries, or structuring distributions over time.

Depending on your situation, a will alone may not be enough. You may need a more advanced option. Jarvis Law Office can walk you through the best options for your individual case.

How Jarvis Law Office Can Help

At Jarvis Law Office, P.C., we make Ohio estate planning simple and stress-free:

- Plain-English guidance: We explain every option clearly, with examples you’ll understand.

- Personalized care: No rushed meetings. We take time to answer every question.

- Elder-law experience: From Medicaid planning to protecting the family home, we know the rules that matter in Ohio.

- Complete plans: Every will comes fully prepared, organized, and ready for your family to use.

- Ongoing support: We’re here for you long after your documents are signed.

If you need a basic will or a full asset-protection strategy, we’ll help you choose the right tools and make sure they work for your life, not just on paper.

Plan Your Will with Clarity and Confidence

A will is a way to protect your wishes, your assets, and your family’s future. The sooner you put it in place, the sooner you can feel confident knowing your loved ones won’t be left guessing or fighting through costly delays.

At Jarvis Law Office, P.C., we guide you through every step, prepare documents that are ready to use, and stay available for you long after the ink dries.

Call us today or visit our contact page to get started on a will that works for your life and protects what matters most.