The main difference between a will and a trust is that a will goes through probate after death, while a trust allows assets to be managed and transferred without court involvement, often avoiding months of legal delay and thousands in fees.

In Ohio, probate can take 9 to 12 months and cost between 3% and 5% of an estate’s value in attorney fees and court costs, according to Ohio State University. That’s why many families explore using a trust to simplify things for loved ones.

At Jarvis Law Office, Ohio families get a real plan, personalized guidance, and long-term peace of mind. With hands-on support for funding and asset transfers and no ongoing premiums that keeps things transparent, clients know exactly what they’re getting and what it protects.

Key Takeaways:

- Trusts help families avoid probate, saving time, legal fees, and preserving privacy.

- Wills and trusts serve different roles, and many families benefit from having both in their estate plan.

- Jarvis Law Office offers flat-fee, personalized estate planning with hands-on support and no surprise costs.

What Is a Will and How Does It Work?

A will is a legal document that directs how your assets should be distributed after you die. It can name guardians for minor children and specify who receives what. In Ohio, wills must be filed through probate court, a public and sometimes lengthy legal process.

According to Caring.com’s 2024 survey, only 32% of Americans have a will or living trust. That leaves many families vulnerable to delays, legal fees, and unintended asset distribution.

What Is a Trust and How Does It Work?

A trust is a legal arrangement where a trustee manages assets on behalf of beneficiaries. Unlike a will, a trust becomes active while you’re alive and can continue after death. Trusts allow you to avoid probate, maintain privacy, and control how and when your assets are distributed.

Revocable trusts allow changes over time, while irrevocable asset protection trusts offer stronger protection of assets in the event of a nursing home stay, medicaid spenddown, lawsuit, etc. .

What if I Move To Another State?

Your documents are still valid, but you may need updates to comply with new state laws. A trust created in Ohio often works in other states, but it is best to check with an attorney in that state to see if anything tweaks are necessary

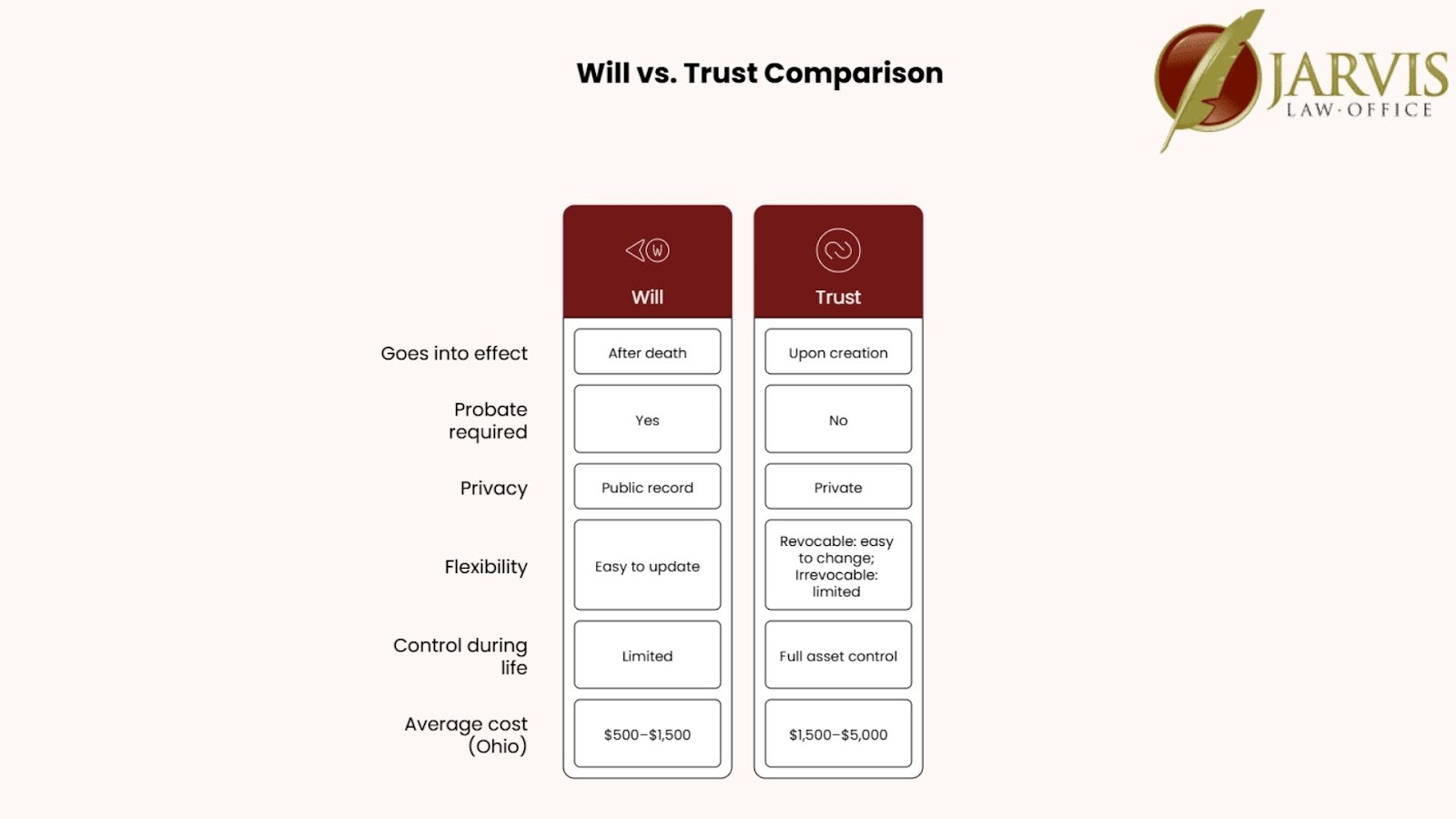

What Are the Key Differences Between a Will and a Trust?

Here are the key differences between a will and a trust:

When Should You Use a Will, a Trust, or Both?

You might choose a will if:

- Your assets are limited

- You’re not concerned about probate timelines or costs

- You need to name guardians for your children

A trust may be better if:

- You want to avoid probate

- You own real estate in multiple states

- You want to protect your beneficiaries from themselves and bankruptcy, creditors or divorce, etc.

- You want to plan for incapacity or long-term care

Many families use both a trust for major assets and a will to handle anything not included in the trust.

Do I Need Both a Will And a Trust?

Often, yes. A trust handles your main assets, while a will covers anything left out.

How Jarvis Law Office Supports Your Planning Process

At Jarvis Law Office, our team helps fund your trust correctly, so your plan works when it’s needed. We charge a flat, one-time fee, no ongoing premiums or surprise bills.

We also work with your financial advisor to keep your investment plans intact. And when questions come up, we answer them without charging you for every call.

Clients consistently praise our clear guidance and compassionate support. As one client put it: “They gave us peace of mind, not just documents in a binder.”

Need Clarity for Your Own Estate Plan?

Understanding wills and trusts is just the start. At Jarvis Law Office, you get clear answers, not pressure. Our team makes the process simple and judgment-free. We don’t charge for questions, and we don’t believe in boilerplate solutions. You’ll get personalized advice, flat pricing, and long-term support without strings.

Contact us today to schedule a free, informative consultation and walk away with real peace of mind.