Understanding the 2026 Federal Poverty Levels (FPL) matters more than most people realize, especially for Ohio families planning ahead for Medicaid, long-term care, or asset protection.

These income thresholds are not just numbers. They directly affect eligibility for programs that can determine whether savings are protected or lost to nursing home costs.

For families dealing with estate planning or Medicaid planning in Ohio, a small difference in income or household size can change whether planning options are available at all. That is why clarity matters from the start.

At Jarvis Law Office, P.C., the focus is not on paperwork alone. The firm helps families understand how rules like the Federal Poverty Levels connect to real planning strategies, especially probate avoidance and trust planning. Clients are guided through how assets are structured, funded, and protected, with clear education and hands-on support.

Key Takeaways

- The Federal Poverty Level (FPL) sets income limits used for Medicaid, ACA subsidies, and other assistance programs

- Medicaid expansion states, including Ohio, typically cover adults earning up to 138% of FPL

- ACA Marketplace subsidies are generally available for households earning between 100% and 400% of FPL, depending on the coverage year and federal law.

- Proper estate and trust planning can help families qualify for Medicaid while avoiding probate and unnecessary expenses

What Are the 2026 Federal Poverty Levels?

The 2026 Federal Poverty Levels (FPL) are income thresholds set each year by the U.S. Department of Health and Human Services to determine eligibility for many federal and state programs. These numbers are adjusted annually and vary by household size and location.

For planning purposes, the Federal Poverty Levels act as a baseline. Programs rarely stop at the base number. Instead, they apply percentages of FPL to decide who qualifies. For example, Medicaid for many adults is tied to 138% of FPL, while other programs use 150%, 185%, or higher thresholds.

According to HHS guidelines, the 2026 FPL for a single-person household in the contiguous United States is $15,960, and for a household of four it is $33,000. Those figures increase with each additional household member.

Understanding this definition matters because income rules often control access to benefits that affect long-term financial security. In elder law and Medicaid planning, the Federal Poverty Levels are often the first measurement used to determine whether planning options remain available.

Who Sets the Federal Poverty Levels?

The Federal Poverty Levels are published annually by the U.S. Department of Health and Human Services (HHS). These guidelines are not estimates or averages. They are official figures used nationwide by agencies that administer Medicaid, SNAP, WIC, and other assistance programs.

Each year’s update reflects inflation adjustments and economic data. That is why relying on last year’s numbers can cause planning mistakes. Eligibility decisions are tied to the correct year’s guidelines, not general assumptions about income.

How the Federal Poverty Level Works

Federal Poverty Levels are adjusted every year to reflect inflation and economic conditions. The income thresholds increase with household size and vary by location, with separate guidelines for Alaska and Hawaii.

Different programs use different FPL percentages:

- Medicaid (Expansion States): Up to 138% of FPL

- ACA Marketplace Subsidies: 100% to 400% of FPL

- CHIP (Children’s Health Insurance Program): Often up to 200%–300% of FPL

- SNAP (Food Assistance): Typically below 130% of FPL

Why Federal Poverty Levels Matter for Planning

Federal Poverty Levels matter because they quietly control access to benefits that protect income and assets. A household that falls just above or below a specific FPL percentage may face very different outcomes.

In Medicaid planning, income limits tied to FPL percentages determine whether an application moves forward or is denied. In estate planning, these same limits influence timing decisions, trust structures, and whether families must spend down assets unnecessarily. Small income differences can change which strategies are available.

For Ohio families planning ahead, understanding the 2026 Federal Poverty Levels provides clarity. It allows decisions to be made early, before a health event or long-term care need forces rushed choices with limited options.

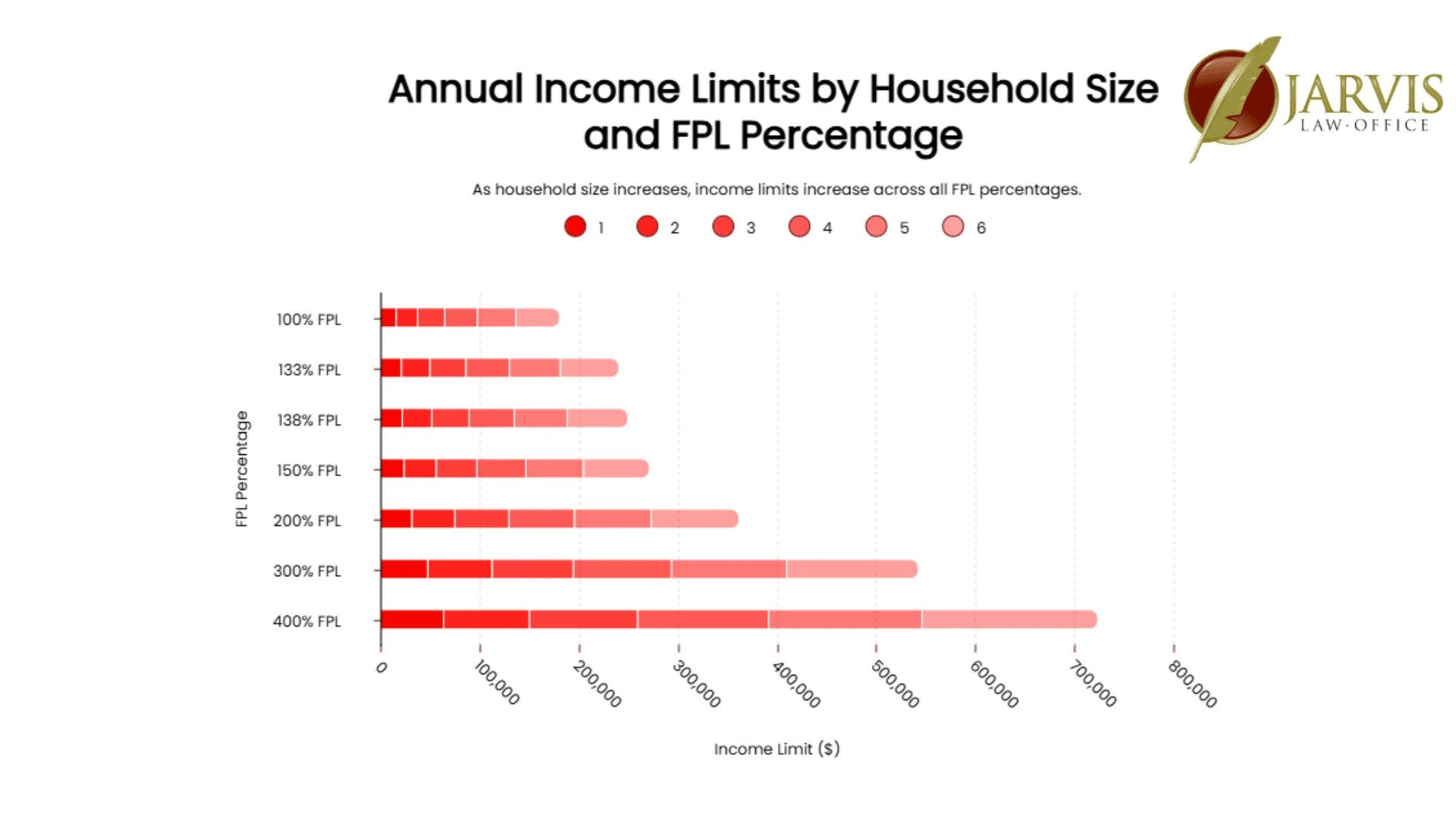

2026 Federal Poverty Levels by Household Size

The 2026 Federal Poverty Levels increase based on household size. Each additional person raises the income threshold, which directly affects eligibility for Medicaid and other income-based programs. For planning purposes, household size must be counted correctly, because even a small error can change eligibility outcomes.

48 Contiguous States and Washington, DC

Annual Income Limits

| Household Size | 100% FPL | 133% FPL | 138% FPL | 150% FPL | 200% FPL | 300% FPL | 400% FPL |

| 1 | $15,960 | $21,227 | $22,025 | $23,940 | $31,920 | $47,880 | $63,840 |

| 2 | $21,640 | $28,781 | $29,863 | $32,460 | $43,280 | $64,920 | $86,560 |

| 3 | $27,320 | $36,335 | $37,702 | $40,980 | $54,640 | $81,960 | $109,280 |

| 4 | $33,000 | $43,890 | $45,540 | $49,500 | $66,000 | $99,000 | $132,000 |

| 5 | $38,680 | $51,444 | $53,378 | $58,020 | $77,360 | $116,040 | $154,720 |

| 6 | $44,360 | $58,999 | $61,217 | $66,540 | $88,720 | $133,080 | $177,440 |

| 7 | $50,040 | $66,533 | $69,055 | $75,060 | $100,080 | $150,120 | $200,160 |

| 8 | $55,720 | $74,108 | $76,894 | $83,580 | $111,440 | $167,160 | $222,880 |

| For over 8, add | $5,680 | $7,554 | $7,838 | $8,520 | $11,360 | $17,040 | $22,720 |

Monthly Income Limits FPL

| Household Size | 100% | 133% | 138% | 150% | 200% | 300% | 400% |

| 1 | $1,330 | $1,768.92 | $1,835.42 | $1,995 | $2,660 | $3,990 | $5,320 |

| 2 | $1,803.33 | $2,398.42 | $2,488.58 | $2,705 | $3,606.67 | $5,410 | $7,213.33 |

| 3 | $2,276.66 | $3,028 | $3,141.83 | $3,415 | $4,553.33 | $6,830 | $9,106.67 |

| 4 | $2,750 | $3,657.50 | $3,795 | $4,125 | $5,500 | $8,250 | $11,000 |

| 5 | $3,223.33 | $4,287 | $4,448.17 | $4,835 | $6,446.67 | $9,670 | $12,893.33 |

| 6 | $3,696.66 | $4,916.58 | $5,101.42 | $5,545 | $7,393.33 | $11,090 | $14,786.67 |

| 7 | $4,170 | $5,544.42 | $5,754.58 | $6,255 | $8,340 | $12,510 | $16,680 |

| 8 | $4,643.33 | $6,175.66 | $6,407.83 | $6,965 | $9,286.67 | $13,930 | $18,573.33 |

| For each over 8, add | $473 | $630 | $653 | $710 | $947 | $1,420 | $1,893 |

Federal Poverty Levels for Alaska and Hawaii

Alaska (Annual)

| Household Size | 100% FPL | 200% FPL | 400% FPL |

| 1 | $19,950 | $39,900 | $79,800 |

| 2 | $27,050 | $54,100 | $108,200 |

| 3 | $34,150 | $68,300 | $136,600 |

| 4 | $41,250 | $82,500 | $165,000 |

Hawaii (Annual)

| Household Size | 100% FPL | 200% FPL | 400% FPL |

| 1 | $18,360 | $36,720 | $73,440 |

| 2 | $24,890 | $49,780 | $99,560 |

| 3 | $31,420 | $62,840 | $125,680 |

| 4 | $37,950 | $75,900 | $151,800 |

Medicaid Eligibility and Federal Poverty Guidelines

Medicaid provides free or low-cost healthcare coverage for low-income individuals, families, seniors, and people with disabilities. Eligibility is based on income, household size, and in some cases, assets.

How FPL Determines Medicaid Eligibility

In Medicaid expansion states, including Ohio, most adults qualify if household income is at or below 138% of the Federal Poverty Level.

Key Medicaid Eligibility Thresholds

| Eligibility Group | Typical FPL Limit |

| Adults (Expansion States) | 138% of FPL |

| Pregnant Women | 138%–200% of FPL |

| Children (Medicaid & CHIP) | Up to 300% of FPL |

| Aged & Disabled (SSI-based) | Around 75% of FPL |

Medicaid Expansion vs. Non-Expansion States

| Feature | Expansion States | Non-Expansion States |

| Adult Coverage | Up to 138% of FPL | Very limited |

| Federal Funding | Enhanced | Limited |

| Coverage Gap | No | Yes |

Ohio is a Medicaid expansion state, which allows broader access to coverage for adults.

ACA Health Insurance Subsidies and FPL

The Affordable Care Act (ACA) provides premium tax credits for individuals and families who earn too much to qualify for Medicaid but still need help paying for health insurance. These subsidies are based on household income as a percentage of the Federal Poverty Level (FPL).

For 2026 coverage, ACA Marketplace subsidies generally rely on the prior year’s Federal Poverty Guidelines (2025 FPL), not the newly published 2026 figures. This timing difference is a common source of confusion and is important when estimating eligibility.

How FPL Affects ACA Marketplace Plans

Under current law effective in 2026, ACA subsidies are available to households earning between 100% and 400% of the applicable Federal Poverty Level.

- 100% – 150% of FPL

Highest level of premium assistance and cost-sharing reductions on silver plans - 150% – 250% of FPL

Moderate subsidies with reduced deductibles and copays - 250% – 400% of FPL

Premium tax credits available, but with less cost reduction - Above 400% of FPL

Subsidies generally do not apply under standard ACA rules in effect for 2026

Households with income above 400% of FPL should not assume subsidies are available unless future federal legislation changes eligibility rules.

Other Assistance Programs Based on FPL

SNAP (Food Assistance)

| Household Size | 130% FPL (Annual) |

| 1 | $20,748 |

| 2 | $28,132 |

| 3 | $35,516 |

| 4 | $42,900 |

SNAP income limits vary by state and household deductions; the figures below reflect general 130% FPL gross income guidelines.

CHIP

CHIP typically covers children in households earning 200%–300% of FPL, depending on the state.

Energy and Housing Assistance

- LIHEAP: Usually 150%–200% of FPL

- Section 8 Housing: Often tied to income limits related to FPL and area median income

WE WILL SPEAK FOR YOUR RIGHTS

Contact us for a free, no obligation consultation to discuss your options. You may find that you are entitled to payment if your claim was denied or underpaid. Let Jarvis Law Office be your advocate

Book Consultation

How to Calculate Your Federal Poverty Level Percentage

- Determine your household size

- Add all gross income sources

- Divide income by the 100% FPL amount

- Multiply by 100

Example:

Family of four earning $48,000

100% FPL = $33,000

$48,000 ÷ $33,000 = 145% of FPL

Common Federal Poverty Level Percentages Explained

Most benefit programs do not rely on the base Federal Poverty Level alone. Instead, they use percentages of FPL to determine eligibility. These percentages expand or narrow access depending on the program, which is why understanding them is just as important as knowing the base income numbers.

100% to 400% Federal Poverty Levels

Federal programs commonly apply income limits ranging from 100% to 400% of the Federal Poverty Level. For example, Medicaid expansion for adults is tied to 138% of FPL, while other assistance programs use thresholds such as 150%, 185%, or 250%.

Using the 2026 guidelines for the contiguous United States, a single-person household at 138% of FPL has an income limit of approximately $22,025, while a household of four reaches that same percentage at about $45,540. These percentage-based calculations are what agencies actually use when reviewing applications.

Higher percentages do not always mean fewer restrictions. Some programs reduce benefits gradually as income rises, while others cut off eligibility entirely once a limit is exceeded. That difference matters when planning ahead, especially for families who fall near a cutoff.

Federal Poverty Levels and Estate Planning Decisions

Federal Poverty Levels are often viewed as benefit rules, but they also shape estate planning decisions. Income thresholds tied to FPL can influence when planning should happen and which legal tools remain available.

Why Income Rules Impact Trust Planning

Income limits connected to Federal Poverty Levels affect how and when trusts are used in planning. Certain Medicaid strategies depend on income staying within defined thresholds. When income exceeds those limits, families may lose access to planning options that could have protected assets.

Planning early allows income and assets to be structured correctly before eligibility becomes urgent. Waiting until care is needed often forces families into short-term solutions that do not provide the same level of protection. Trust planning done with awareness of FPL rules helps avoid last-minute decisions that can create problems.

Probate Avoidance and Asset Protection Considerations

Probate avoidance is not only about convenience. It also affects how assets are counted and accessed when benefits are needed. Improperly titled assets or incomplete trust funding can push families into probate and expose assets to unnecessary loss.

When estate plans are coordinated with income-based eligibility rules, families are better positioned to protect what they have built. This includes ensuring assets are titled correctly, trusts are funded properly, and planning decisions align with current Federal Poverty Levels rather than outdated assumptions.

Federal Poverty Levels Change Every Year

Federal Poverty Levels are not fixed rules. They change every year, and those updates can directly affect eligibility decisions and planning outcomes. Using the wrong year’s numbers is one of the most common mistakes families make when researching income limits on their own.

Why Using the Wrong Year’s FPL Causes Problems

Each year, the U.S. Department of Health and Human Services updates the Federal Poverty Levels to reflect economic changes. Programs then adopt those numbers based on their own timelines. As a result, the calendar year and the program year do not always match.

For example, Medicaid or health coverage decisions may rely on the prior year’s FPL, while other assistance programs switch to the new figures shortly after release. Families who rely on outdated charts or generic online calculators may believe they qualify when they do not, or assume they are over the limit when options still exist.

Accurate planning depends on confirming which year’s Federal Poverty Levels apply to the specific program being considered.

Planning Ahead Instead of Reacting

When planning is done ahead of time, annual changes to Federal Poverty Levels are easier to manage. Income can be evaluated in advance, and strategies can be adjusted before a deadline or crisis forces action.

Reactive planning often happens after a health event or long-term care need appears. At that point, annual FPL changes can limit options and increase stress. Proactive planning allows families to account for future updates and make decisions that remain effective even as rules evolve.

Getting Clear Guidance for Ohio Families

Federal Poverty Levels provide structure, but they do not provide answers on their own. Knowing the numbers is only the first step. What matters is how those numbers apply to your income, your assets, and your long-term plans.

Clear guidance helps bridge that gap. When families understand how Federal Poverty Levels interact with Medicaid rules and estate planning strategies, decisions become calmer and more deliberate. Planning stops being reactive and starts to feel manageable.

At Jarvis Law Office, we focus on education and follow-through, which allows families to move forward with confidence.

If you are in Ohio and have questions about FPL, contact us today.