According to AHCA/NCAL in 2025, 63% of nursing home residents rely on Medicaid as their primary payer.

At the same time, Genworth’s 2024 Cost of Care Survey pegs the median price of a semi-private nursing-home room in Ohio at $108,405 a year, roughly $9,000 every month. When your application is denied, that kind of bill can devour a lifetime of savings almost overnight.

But a denial letter is not the last word. You have 90 days to request a state hearing, and importantly, if the Bureau of State Hearings (BSH) gets your request within 15 days of the notice date, your services stay in place while the appeal is decided.

At Jarvis Law Office, clients get straightforward strategies to keep what matters most. Our team here focuses on making probate avoidance simple, helping families manage asset transfers into trusts with confidence and one-time, affordable fees.

Key Takeaways

- Medicaid covers most nursing home care in Ohio, but a denial can quickly lead to high out-of-pocket costs.

- You can appeal within 90 days and keep benefits going by filing within the first 15 days.

- Many denials are fixable with proper paperwork or legal tools like a Qualified Income Trust.

What Is the Ohio Medicaid Long-Term-Care Appeal Process?

Getting a denial for nursing-home, PASSPORT, or Assisted-Living-Waiver Medicaid does not end your right to coverage. Ohio law gives every senior (or their representative) a clear, two-tier pathway to fight the decision through the Bureau of State Hearings (BSH).

- 90-day filing window: Your written “State Hearing Request” must reach BSH within 90 calendar days of the denial notice.

- 15-day “continued-benefits” window: File within the first 15 days and, if you are already in a facility or on a waiver, Medicaid continues paying while the appeal is decided.

Who Can Appeal a Medicaid Denial in Ohio?

Anyone connected to the long-term-care application may sign and submit the hearing request, including:

- The elder applicants themselves.

- A spouse, adult child, or caregiver managing finances or care.

- A legal representative, guardian, power-of-attorney, or attorney-at-law.

- A facility social worker or advocate with the senior’s written consent.

Ohio treats all of these parties as “authorized representatives,” so they can file, present evidence, and speak at the hearing on the applicant’s behalf.

Why Your Odds Are Better in Ohio

During the 2023-24 nationwide “unwinding,” the Ohio Department of Medicaid reported that the state had one of the lowest procedural disenrollment rates in the country, 11th best at keeping eligible people covered.

That same eligibility system handles appeals, so seniors who meet the deadlines and supply the missing paperwork often succeed here more readily than elsewhere.

Why Are Medicaid Applications Denied in Ohio?

Denials usually happen for a few main reasons:

- Assets above $2,000 (single applicant) or failure to document spend‑down.

- Monthly income above $2,901 without depositing the excess into a Qualified Income Trust (Miller Trust).

- Uncompensated transfers within 60 months, gifts to children, adding them to deeds, etc.

- Missing Level‑of‑Care assessment (for PASSPORT, Assisted‑Living, or Nursing‑Facility Medicaid).

- Home equity above $713,000 (2025 limit) when no exempt spouse or minor/disabled child lives in the home.

How a Qualified Income Trust Fixes Income Over the Limit

Ohio’s income cap for nursing-home and PASSPORT Medicaid is $2,901 per month in 2025. If your income is even one dollar higher, eligibility requires a Qualified Income Trust (QIT), sometimes called a Miller Trust.

A valid QIT must:

- Be irrevocable and written under Ohio law

- List the Medicaid applicant as the sole lifetime beneficiary

- Name a trustee (often a spouse or adult child)

- Have its own Ohio bank account where all “excess” income is deposited each month

- Pay only allowable expenses, namely ,the applicant’s Medicaid patient liability, bank fees, and a small personal-needs allowance, before the balance automatically goes to the state upon death.

Create the trust before or at the same time you reapply, then deposit the income right away. Back-dated trusts are rarely accepted.

Not Sure if You Qualify?

To help avoid common mistakes and get a better idea of your eligibility before applying, you can use our newest Medicaid Eligibility Tool. This quick, confidential tool guides you through the main requirements and lets you know if you might qualify, so you can address any issues ahead of time and reduce your chances of being denied.

What Rights Do You Have After a Medicaid Denial in Ohio?

The following protections make the appeal process user-friendly, especially for seniors facing long-term-care bills, so use them to gather missing paperwork, correct errors, and keep coverage in place while your case is decided.

- You can appeal any Medicaid decision. Ohio’s rules guarantee a “fair hearing” whenever the Department of Medicaid or your County DJFS denies, reduces, or ends your benefits. You have 90 calendar days from the date on the denial notice to file that request.

- Filing fast keeps the checks coming. If you are already in a nursing home or on a waiver and you submit the hearing request within 15 days of the notice date, Medicaid must keep paying while the appeal is pending, often called “continued benefits.”

- You may review your entire case file. Before the hearing, you have the right to inspect the documents the agency relied on and to receive its written appeal summary at least three business days in advance.

- Bring help if you wish. You may represent yourself or be represented by a spouse, adult child, attorney, guardian, or another authorized advocate. The agency cannot require you to appear alone.

Understanding the Medicaid Appeal Process in Ohio

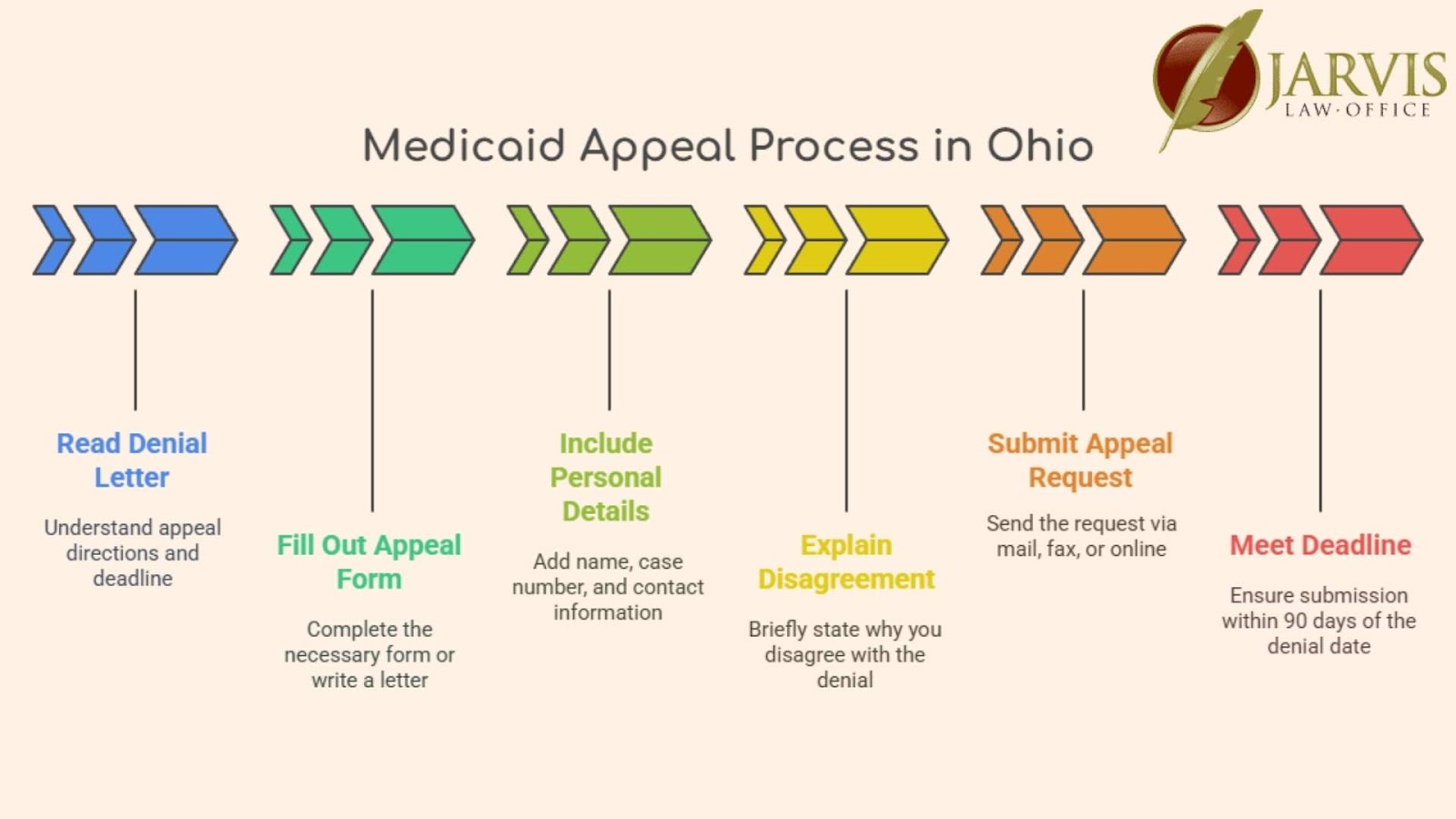

Appealing a Medicaid denial in Ohio is straightforward if you follow the correct steps and meet every deadline.

How to File a Medicaid Appeal

- Review the denial letter carefully. It explains the rule applied and your deadline to appeal.

- Submit a “State Hearing Request” using the form provided or a short letter that includes the applicant’s name, case/Medicaid ID, contact info, and a brief reason for the appeal.

- You can email (bsh@jfs.ohio.gov), fax (614-728-9574), mail (ODJFS Bureau of State Hearings, P.O. Box 182825, Columbus, OH 43218-2825), or hand-deliver the request to your County Department of Job & Family Services.

- Deadlines matter: you have 90 days to file and 15 days to keep benefits going if you’re already receiving care.

- Keep proof of your submission, like screenshots, postal receipts, or email confirmations are all valid.

What Documents Do I Need for an Ohio Long-Term-Care Medicaid Appeal?

Having the following documents ready will make your appeal stronger and your hearing easier to prepare for.

| Required Paperwork | Senior-Specific Adds |

| Denial letter & original application | Five years of bank, brokerage, and retirement statements (look-back rule) |

| Photo ID & proof of Ohio residency | Real-estate deeds, transfer-on-death affidavits, life-estate deeds |

| Latest tax return or income proof | Level-of-Care form ODJFS 02399 (or facility LOC packet) |

| Current bank balances & asset list | Burial contracts and life-insurance cash-value statements |

| Any correspondence with Medicaid | Signed Qualified Income Trust (if income > $2,901/month) |

Ohio Medicaid Appeal Deadlines and Timelines

| Step | Typical Timeframe |

| Hearing request due | Within 90 days of notice |

| Hearing scheduled | Scheduling notice sent ≥10 days before the hearing |

| Hearing held | Usually 30-40 days after request (may be phone or in-person) |

| Written decision mailed | Within 90 days of your request |

Missing the 90-day filing window almost always means starting over, so file first, then gather documents.

With the 15-day continued-benefits rule, the SHARE portal, and a thorough document packet, seniors can keep care in place while correcting the issues that led to denial. If any of this feels overwhelming, an elder-law attorney or facility social worker can submit the appeal on the resident’s behalf.

How Does the Ohio Medicaid State Hearing Work?

- Neutral decision-maker. Your case is decided by an independent Bureau of State Hearings (BSH) officer, not the county that denied you. Hearings may be held by phone, video, or in-person, video counts as face-to-face.

- Quick scheduling. After your request is logged, BSH usually sets the hearing within about 30 days and blocks one hour.

- Bring proof and people. You may submit documents, call witnesses (e.g., your nursing-home social worker or doctor), and be represented by a spouse, POA, or attorney.

How to Prepare for Your Ohio Medicaid Hearing

- Assemble two copies of key papers: The officer keeps one copy for the record, and you keep one to follow along.

- Highlight no more than five talking points: This keeps your testimony focused on key issues such as income miscalculation, assets already spent, or exempt transfers.

- Rehearse a five-minute timeline: Hearing slots are short, and practicing helps you stay calm and concise.

- Line up witnesses: Facility staff or physician letters can provide proof of medical need and spend-down facts.

- Request accommodations early: BSH will arrange a phone or video call if travel is difficult, or provide other accommodations like wheelchair access or an interpreter.

How to Fix Common Errors and Reapply for Medicaid in Ohio

If your Medicaid application was denied because of a simple mistake or missing information, you can fix the problem and try again.

How to Correct Application Mistakes and Missing Documents

If the denial is clearly tied to missing pay stubs, unsigned QIT paperwork, or a late Level-of-Care form, it can be faster to correct the file and submit a fresh application:

- Match the denial letter line-by-line, circle every document the county says is missing.

- Gather or re-sign the items, making sure dates and account numbers match exactly.

- Upload the new application through the Ohio Benefits portal (or hand-deliver to CDJFS) and keep the stamped receipt.

- Save a complete copy for your records. If the correction still fails, you can appeal with stronger evidence.

When Should You Reapply Instead of Appealing?

- Your finances changed. Maybe you spent down excess assets on care or your monthly income dropped below the $2,901 limit. A new application reflects the updated figures without waiting for an appeal hearing.

- You missed the 90-day appeal deadline. Once that window closes, the only way forward is a brand-new filing.

- The denial was clearly a paperwork mistake. Examples include an unsigned Qualified Income Trust, a missing pay stub, or a Level-of-Care form that hadn’t been scanned yet. Correct the file, resubmit, and you can be approved in weeks instead of months.

- Household circumstances shifted. A spouse entered a facility, passed away, or you divorced, events that change the spousal-asset calculation and may now qualify you immediately.

Remember, Ohio accepts Medicaid applications year-round, there’s no open-enrollment period, so you can file again whenever you believe you meet the rules.

What Do Legal Aid and Advocates Do for Your Appeal?

Having a legal aid advocate can make the process less stressful and improve your chances of success. They can:

- Review your denial letter and help you understand your rights.

- Assist with filling out and submitting appeal forms.

- Help gather evidence and documents to support your case.

- Represent you at a hearing or give you advice on what to say.

Protect Your Future with Trusted Ohio Medicaid Guidance

Medicaid denials feel overwhelming, but by acting quickly you can keep long-term-care bills from draining a lifetime of savings.

If you’d like experienced guidance at any stage, Jarvis Law Office is here to help. For straightforward answers or to get help with your next steps, connect directly with our team through our contact page.