Wondering how to protect your home or savings from nursing home costs without losing control of your assets?

According to FamilyAssets, the average cost of nursing home care in Ohio is $93,078 per year. That kind of expense can quickly drain your life savings. A Medicaid Asset Protection Trust (MAPT) offers a strategic way to shield your assets while becoming eligible for Medicaid.

At Jarvis Law Office, Ohio families find lasting peace of mind. Our team walks you through every step of making a trust, gives guidance on how to transfer your assets, and provides the tools to manage it with clarity, support, and long-term protection for your future.

What Is a Medicaid Asset Protection Trust?

A Medicaid Asset Protection Trust (MAPT) is a kind of hybrid irrevocable trust designed to help you qualify for Medicaid while protecting your home, savings, and other assets from long-term care costs.

Unlike a standard living trust, a MAPT makes sure that those assets won’t be counted when Medicaid determines eligibility, provided you made the transfers 5 years before you need care, helping preserve your legacy for your family.

In simple terms, once you transfer or ‘gift’ your assets into an MAPT, you no longer legally own them. But that doesn’t mean you lose all control. You can still name your trustee (which can be you!), decide who inherits what, and even live in your home. The key is that Medicaid sees those assets as no longer yours, helping protect them from spend-down rules.

MAPTs are especially useful for individuals or couples who:

- Own a home or have more than $2,000 in countable assets (the Medicaid limit for individuals in Ohio)

- Want to shield assets from future nursing home costs

- Need to qualify for Medicaid in the next few years

They’re most effective when created early, before a care crisis hits, so the five-year look-back rule doesn’t cause delays or penalties. If you’re planning ahead, a MAPT gives you options without risking your home or savings.

If you are likely to need care, but don’t have a full 5 years, that is okay. You still have options. The MAPT can still help protect a portion of your assets so that you aren’t just left with the state’s plan that would force you to spend down to $2,000.

Who Needs a MAPT?

If you’re worried about how nursing home bills could impact your family’s financial future, a Medicaid Asset Protection Trust (MAPT) might be exactly what you need. It’s designed for people who want to protect what they’ve worked for, especially their home and life savings, while still qualifying for long-term care through Medicaid.

Use Cases for Seniors and Caregivers

MAPTs are ideal for:

- Seniors planning ahead for potential nursing home care

- Adult children helping parents protect their home and assets

- Couples where one spouse might need Medicaid and the other wants to stay in the home

Without proper planning, even a few years of care could drain an entire estate. A MAPT offers a way to protect those funds from being counted when applying for Medicaid.

Common Triggers: Home Ownership, Savings, and Long-Term Care Planning

You don’t need to be wealthy to benefit from a MAPT. In fact, people with the following are strong candidates for this type of trust:

- A paid-off or partially paid-off home

- More than $50,000 in savings or retirement funds

- Concerns about dementia, chronic illness, or mobility loss

Many families wait too long until a health crisis forces quick decisions. Setting up a MAPT while you’re still healthy allows for more options, less stress, and better financial outcomes down the line.

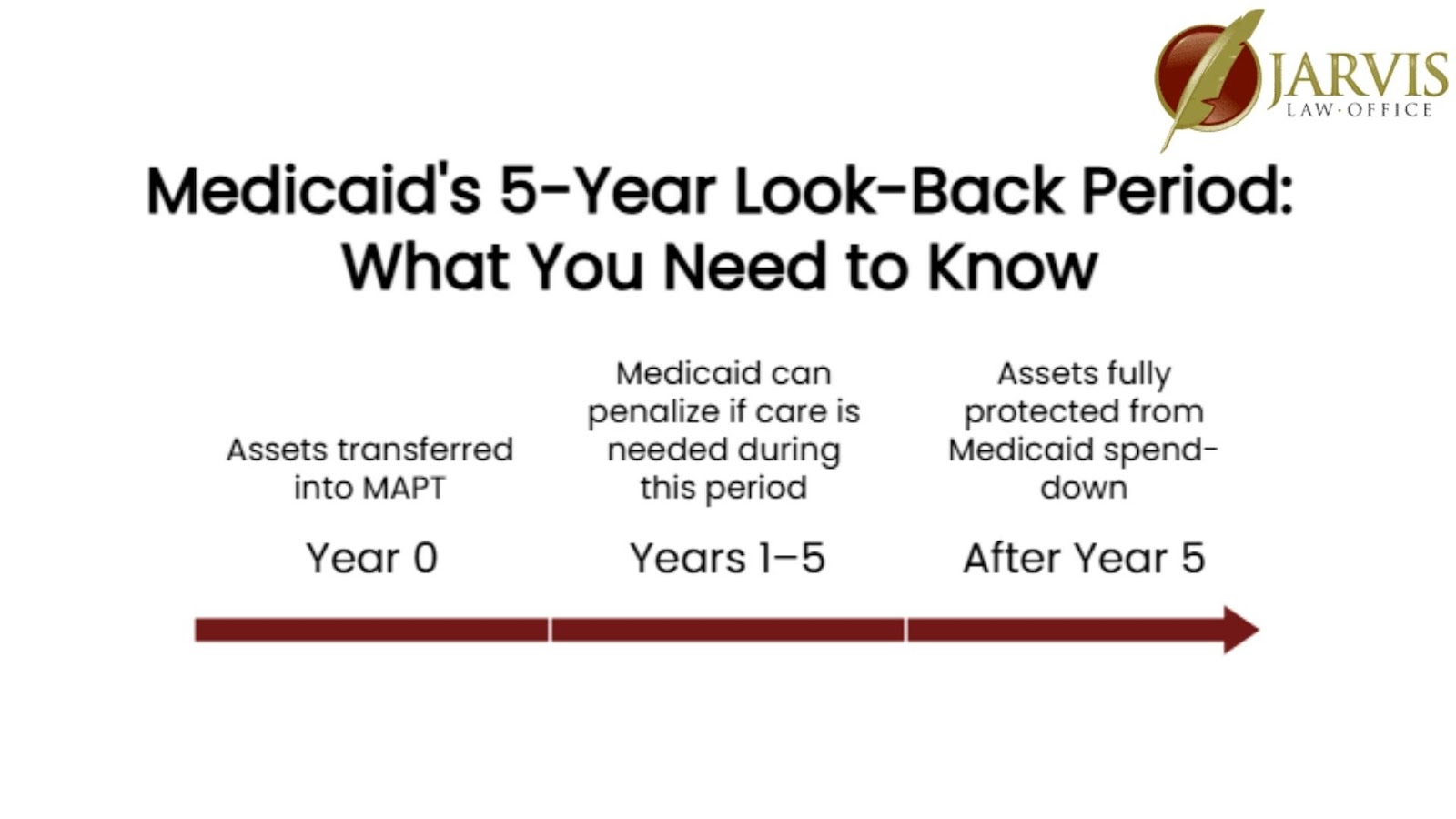

Understanding the 5-Year Look-Back Rule

When it comes to qualifying for Medicaid, timing matters, and that’s where the five-year look-back rule becomes important. This rule means Medicaid will examine all financial transfers made within the 60 months (5 years) before you apply.

If they find assets were moved for less than fair market value, you could face a penalty period where you’re ineligible for Medicaid.

What It Means

Say you transferred your home into a Medicaid Asset Protection Trust today, then needed nursing home care three years later. Because the transfer happened within that five-year window, Medicaid would consider it a “gift,” triggering a penalty based on the value of the home.

Creating a MAPT before you need care allows the five-year clock to run out, so when the time comes, your assets are already protected and Medicaid can’t count them against you.

Even if you haven’t completed the full 5-year Medicaid lookback period, you still have meaningful options. The further you are into the lookback, the more flexibility you have, and typically, the more assets you can help protect.

In many cases, even without a full 5 years, you can still preserve about half of a family’s assets, depending on factors like income and care costs. With the benefit of a full 5-year window, however, the opportunity for asset protection increases significantly.

How Much Does a MAPT Cost?

The cost to set up a Medicaid Asset Protection Trust typically ranges from $2,000 to $12,000 in Ohio, depending on the intricacy of your assets and the attorney’s experience. Factors that can affect the fee include:

- Whether both spouses need protection

- How many properties or financial accounts are involved

- The need for custom clauses or planning layers

Trusts on the lower end of the range may cover basic asset protection, and are unlikely to include support or direction on how to properly transfer your assets to receive the protections that the trust offers.

Spending a little more up front could end up saving you tens or hundreds of thousands down the road. This is not an area of the law that you can short cut or ‘dabble’ in. You need a law firm that understands the nuances of Medicaid Asset Protection planning and focuses all of their time and energy staying up to date on the ever changing laws.

How a MAPT Shields Your Assets from Nursing Home Costs

A Medicaid Asset Protection Trust (MAPT) acts like a legal firewall between your hard-earned assets and long-term care costs. It repositions your wealth so that Medicaid doesn’t count it against you when you apply for help.

Countable vs Exempt Assets

Medicaid only allows an individual to have $2,000 in countable assets in Ohio. That includes cash, investment accounts, and non-exempt property. If you have more than that, you’ll be expected to spend down those funds before Medicaid steps in.

When assets like your home or savings are transferred into this irrevocable trust (outside the five-year look-back period), they’re no longer considered “yours” by Medicaid.

Common assets families protect with a MAPT:

- Primary residence

- Checking, Savings, CD. accounts

- Non-retirement investment accounts

- Second properties or rental income

- Oil, gas & mineral rights, and royalties

- Life insurance with cash value

- Business interests

Once inside the trust for 5 years, these assets are safe from spend-down requirements, estate recovery, and liens, even if you eventually need full-time nursing home care.

What If I Need to Make Changes?

Because MAPTs are irrevocable, you can’t simply undo or change them at will. But you can:

- Update your beneficiaries

- Replace your trustee (in most setups)

- Add new assets with legal guidance

The trust must be carefully designed up front to reflect your long-term goals. That’s why working with an experienced firm like Jarvis Law Office is so important, getting it right the first time matters.

Can I Keep My House?

Yes. In fact, most MAPTs are used to protect the home. You can:

- Keep living in it & receive the home owner occupied and homestead credits on your taxes

- Maintain and renovate it

- Pass it on to your heirs without Medicaid estate recovery

By transferring the home into a MAPT at least five years before needing care, you shield it from both the spend-down process and potential recovery after death.

How Long Does It Take to Set Up an MAPT?

Most MAPTs take about 4–8 weeks to create and fund properly. That includes:

- An initial consultation

- Drafting and signing the trust

- Transferring title to your home

- Working with your financial institutions to transferfinancial accounts

- Guidance on ongoing funding or updates

Take Control with the Right Planning

Protecting your home, savings, and independence doesn’t have to be overwhelming or expensive. A Medicaid Asset Protection Trust (MAPT) gives Ohio families a powerful, legally sound way to preserve what matters most, before it’s too late.

By understanding the five-year look-back rule, planning early, and working with a firm that offers transparency, you can avoid common mistakes and secure your legacy with confidence.

At Jarvis Law Office, we make the process clear, compassionate, and stress-free. If you’re planning ahead or responding to new health concerns, our team is here to help you take the next step on your timeline, with no pressure.

Contact us today to schedule your free strategy session. Let’s build your plan now, so you can protect your future without worry.