Planning for the future is vital, especially when it comes to protecting your assets and making sure your loved ones are cared for.

As of early 2025, approximately 3 million Ohioans, roughly 26% of the state’s population, are enrolled in Medicaid, according to Health Policy Ohio. This growing trend indicates the importance of staying informed about Medicaid eligibility, benefits, and rights.

At Jarvis Law Office in Ohio, we focus on guiding individuals and families through the troubles of estate planning. Our dedicated team assists in transferring assets into trusts, providing you with the necessary tools to manage these processes confidently.

Key Takeaways

- Medicaid Estate Recovery mainly targets probate assets while non-probate assets are often protected.

- Exemptions exist to protect family members, primary residences, and personal belongings.

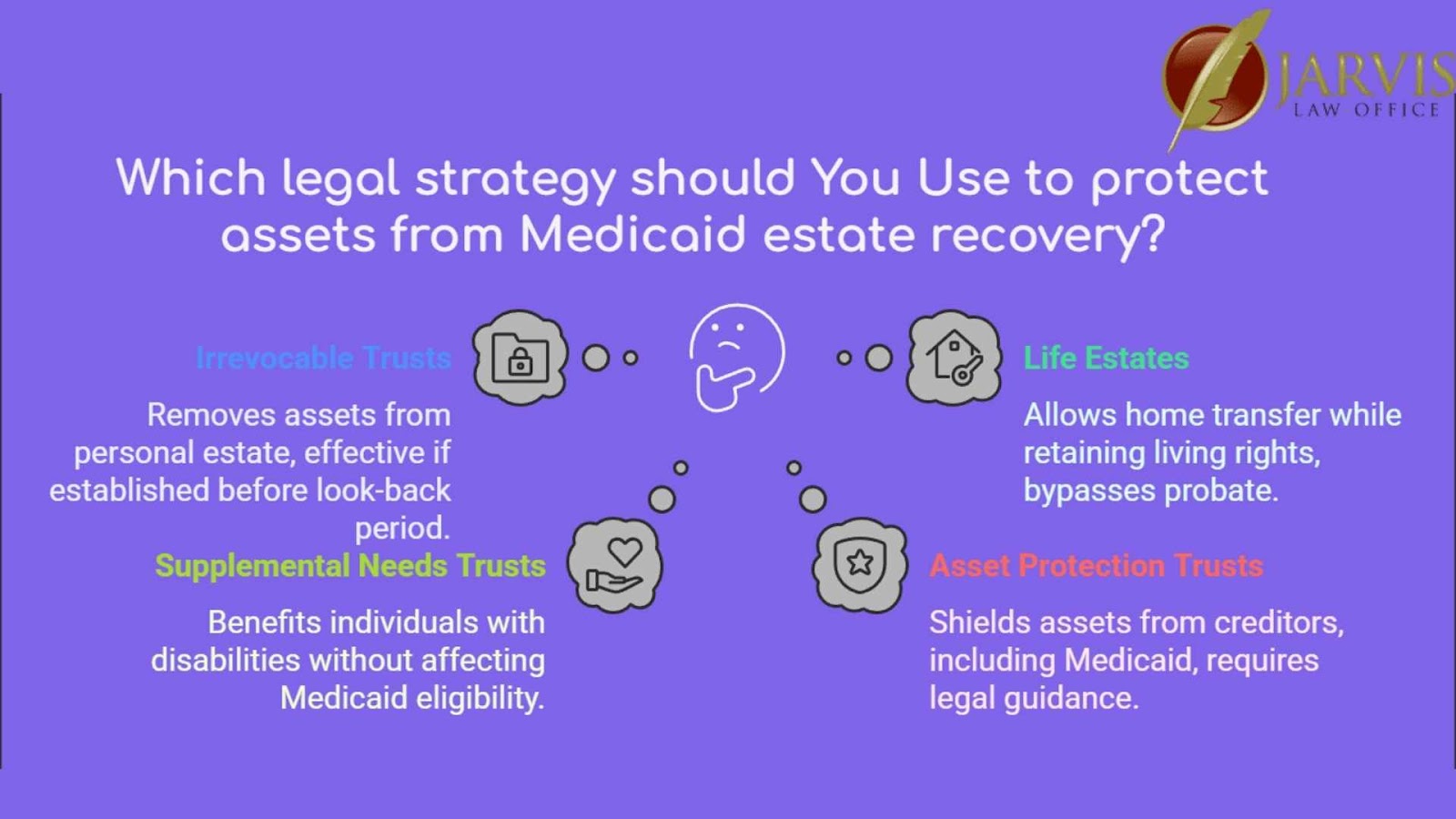

- Legal strategies like Irrevocable Trusts, Life Estates, and Asset Protection Trusts can help shield assets.

- Ohio has more aggressive recovery rules than many states, often going after non-probate assets, making early, state-specific planning important.

What Is Medicaid Estate Recovery?

Medicaid Estate Recovery is a process mandated by federal law, requiring state Medicaid programs to seek reimbursement from the estates of certain deceased beneficiaries for payments made on their behalf. This typically includes costs associated with long-term services and support (LTSS).

Recovery often affects individuals with modest means and can perpetuate intergenerational poverty.

Which Assets Are Subject to Medicaid Estate Recovery?

Medicaid seeks reimbursement from certain assets in your estate after you pass away. Understanding which assets are subject to recovery can help in planning and protecting your legacy.

Probate vs. Non-Probate Assets

Medicaid primarily targets probate assets for recovery. These are assets that go through the probate process after death, such as:

- Solely owned real estate

- Bank accounts in your name only

- Personal property

Non-probate assets, which typically bypass probate and may be less susceptible to recovery, include:

- Jointly owned property with rights of survivorship

- Life insurance policies with designated beneficiaries

- Retirement accounts with named beneficiaries

State Variations

Medicaid estate recovery rules can vary significantly by state. Some states may pursue recovery beyond probate assets, including:

- Assets held in revocable living trusts

- Jointly owned assets without rights of survivorship

For instance, states like Massachusetts and Ohio have broader recovery practices, extending to non-probate assets. Make sure to consult local regulations or an elder law attorney to understand specific rules in your state.

What Assets Are Exempt from Medicaid Estate Recovery?

Understanding which assets are exempt from Medicaid Estate Recovery can help you protect your estate for your loved ones.

Homestead Exclusion

Your primary residence is often protected from Medicaid recovery, especially if certain family members live there:

- Surviving Spouse: If your spouse is still living in the home, Medicaid cannot claim it.

- Minor, Blind, or Disabled Children: The home is exempt if you have children under 21, or any age if they are blind or disabled.

These protections make sure that your family can continue to reside in the home without disruption.

Personal Property and Other Exemptions

Beyond your home, several other assets are typically safe from Medicaid recovery:

- Personal Belongings: Items like clothing, furniture, and household goods are not subject to recovery.

- Certain Income-Producing Property: If you own property that generates income essential for your family’s support, it may be exempt.

- Irrevocable Trusts: Assets placed in certain irrevocable trusts may be protected, provided they were transferred outside of Medicaid’s “look-back” period.

It’s important to note that rules can vary by state. Consulting with an elder law attorney can provide guidance tailored to your specific situation.

How Do Medicaid Liens Work?

Medicaid can place liens on your property to recover costs for medical services provided. Understanding how these liens work is important for effective estate planning.

Pre-Death Liens

Medicaid may impose a lien on your property during your lifetime under specific circumstances:

- Permanently Institutionalized Individuals: If you’re in a nursing home indefinitely, Medicaid can place a lien on your home to recover expenses.

However, similar to the homestead exemption, a spouse or children living at the property can prevent Medicaid from placing a lien.

Post-Death Liens

After your death, Medicaid seeks reimbursement for the costs of your care:

- Estate Recovery: Medicaid can claim against your estate, including your home, to recover expenses.

However, recovery is delayed if your spouse or children survive you.

What Strategies Can Protect Assets from Medicaid Estate Recovery?

Implementing legal strategies can help protect assets from Medicaid estate recovery. Options such as establishing irrevocable trusts or life estates can be effective in protecting property from recovery efforts, depending on individual circumstances and timing. Here are some approaches to consider:

Irrevocable Trusts

An Irrevocable Trust is a legal arrangement where you transfer ownership of certain assets to the trust, effectively removing them from your personal estate. Once established, you cannot modify or revoke the trust, which makes sure that the assets are no longer considered yours for Medicaid eligibility purposes.

This strategy can protect your assets from recovery, provided the transfer occurs outside of Medicaid’s “look-back” period, which is typically five years.

Life Estates and Transfer Techniques

Creating a Life Estate allows you to transfer ownership of your home to a beneficiary, such as a child, while retaining the right to live there for the rest of your life. This method can protect the property’s value from Medicaid recovery, as the remainder interest passes directly to the beneficiary upon your death, bypassing probate.

However, it’s important to establish a life estate well before applying for Medicaid to avoid penalties associated with asset transfers within the look-back period.

Supplemental Needs Trusts

A Supplemental Needs Trust (SNT), also known as a Special Needs Trust, is designed to benefit individuals with disabilities by holding assets on their behalf without affecting their eligibility for government benefits like Medicaid.

While SNTs are primarily used for disabled beneficiaries, they can also serve as a tool in Medicaid planning for others, making sure that assets are used to increase the quality of life without jeopardizing benefit eligibility.

Asset Protection Trusts

An Asset Protection Trust is a type of trust designed to protect your assets from creditors, including Medicaid estate recovery. By placing assets into this trust, you relinquish control over them, which can make them inaccessible to satisfy Medicaid claims.

The effectiveness of this strategy depends on timing and adherence to state laws, so it’s important to consult with a legal professional experienced in Medicaid planning.

How Does Ohio’s Medicaid Estate Recovery Program Differ from Other States?

Ohio’s approach to Medicaid estate recovery is notably aggressive compared to other states. The state actively seeks repayment for Medicaid benefits from the estates of deceased beneficiaries, including costs beyond long-term care services.

This comprehensive recovery effort places Ohio among the top five states in collections, with over $55 million recovered in a recent year.

Secure Your Legacy with Jarvis Law Office

Planning for the future can be daunting, but at Jarvis Law Office, we’re here to make it straightforward. We offer a cost-effective, one-time fee option, providing a practical alternative to ongoing expenses like life insurance.

Ready to take the next step? Visit our contact page to schedule a consultation today.