When certain medical bills, such as prescriptions, durable medical equipment, or transportation to medical appointments, push your countable income or assets below Ohio’s eligibility limits, you can “spend down” to qualify for Medicaid, specifically for individuals above 65.

With 1 in 4 Ohio residents enrolled in Medicaid, about 3 million people, according to the Health Policy Institute of Ohio, this process is a lifeline for many families. Even after federal continuous enrollment protections ended, Ohio’s Medicaid enrollment remains 9% higher than before COVID-19, showing the ongoing need for clear guidance.

At Jarvis Law Office, we help Ohio families understand these rules so they can protect what they’ve built, preserve dignity, and avoid costly mistakes.

What is Medicaid Spend-Down?

Medicaid spend-down is a way to qualify for Medicaid by using allowable expenses to lower your countable income/assets below state limits.

Medicaid Spend-Down Eligibility in Ohio

Being 65 or older, spend-down eligibility in Ohio depends on your financial situation and the type of Medicaid coverage you need.

- Asset limits (2025):

- Individuals: $2,000

- Married applicants: Community spouse can keep up to $157,920 under the Community Spouse Resource Allowance (CSRA)

- Medicaid also applies a spend-down floor of $27,480 and a ceiling of $137,400 for certain married couples based on state rules.

- Annual costs: Ohio spends about $9,520 per Medicaid enrollee each year, which shows why accurate planning matters to both families and the state budget.

- Five-year look-back period: Ohio Medicaid reviews asset transfers made in the last 60 months. Any transfer for less than fair market value can trigger a penalty period, delaying coverage.

Because of these rules, planning and precise recordkeeping are critical. Even a small documentation error or ill-timed transaction can delay eligibility. Check out the most recent 2026 Medicaid eligibility rules here.

How is My Spend-Down Calculated?

Medicaid spend-down is calculated by subtracting Ohio’s Medicaid limits from your countable income/assets.

What is The Five-Year Look-Back?

The five-year lookback period is a review of asset transfers made in the past 60 months, improper transfers can cause a penalty period.

Can Spend-Down Be Avoided?

Sometimes spend-down can be avoided by utilizing early planning using tools like trusts, prepayments, and legal exemptions. When you work with a Jarvis Law Firm attorney, we’ll help you put the right tools in place to protect your assets and secure the best possible future.

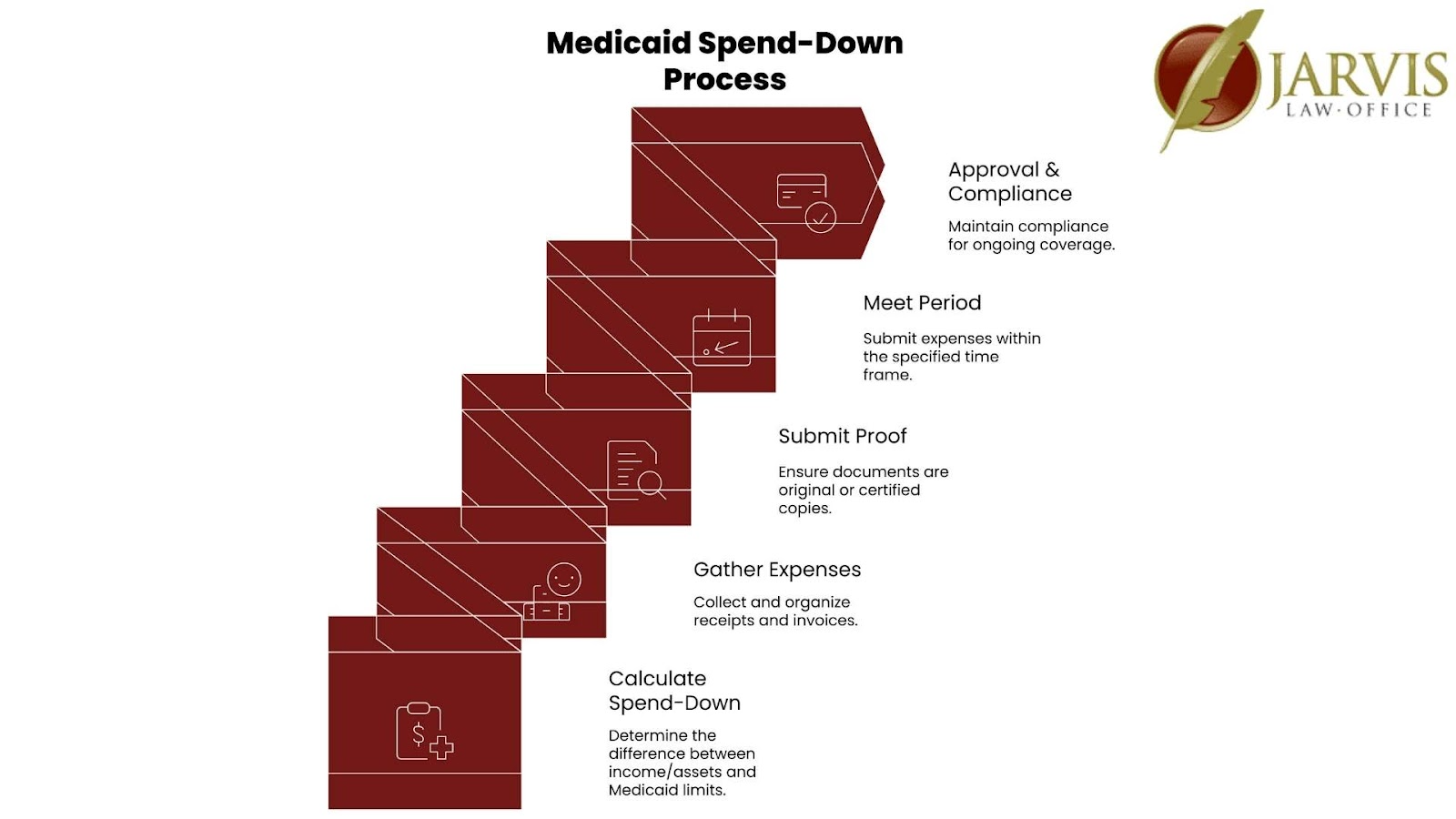

Ohio’s Spend-Down Process Step-by-Step

1. Determine Your Spend-Down Amount

Your county caseworker will calculate the difference between your countable income/assets and Ohio’s Medicaid limits. This difference is the amount you need to “spend down” for that eligibility period.

2. Gather and Submit Proof of Expenses

Keep receipts, invoices, and proof of payment organized by date. Make sure each document shows the provider’s name, service date, and payment amount.

Use original copies, not regular photocopies.

3. Meet the Spend-Down Period

Spend-down periods are often monthly or six months long. Submit all expenses within that window, since late submissions are typically denied.

4. Approval and Ongoing Compliance

Once you meet your spend-down, Medicaid coverage begins for the remainder of that period. For recurring spend-downs, repeat the process each cycle. Remember, the five-year look-back on asset transfers still applies.

At Jarvis Law Office, P.C, we work with you to help you protect your assets so that you can avoid spend-down entirely.

Qualifying Expenses in Ohio’s Spend-Down Program

Not every cost will count toward your Medicaid spend-down. Ohio recognizes a wide range of health-related expenses, but they must be necessary, properly documented, and tied to medical care. Here are some qualifying expenses:

Medical Care & Professional Services

- Doctor visits and consultations

- Hospital stays and outpatient procedures

- Laboratory testing, X-rays, and imaging

- Chiropractic care (if medically necessary and covered)

Prescriptions & Medical Supplies

- Prescription medications

- Over-the-counter drugs prescribed by a doctor

- Insulin, diabetic test strips, wound care products

- Oxygen tanks, respiratory equipment

Health Insurance Premiums & Co-Pays

- Medicare Part B, Part D, and Medicare Advantage premiums

- Private health insurance premiums

- Co-pays for visits or prescriptions

- Annual deductibles

Home Health Care & Nursing Services

- Licensed home health aide visits

- Skilled nursing care in the home

- Physical, occupational, and speech therapy sessions

Transportation to Medical Appointments

- Mileage reimbursement at Ohio’s approved rate

- Public bus or train fares

- Taxi or rideshare costs for medical trips (non-emergency)

State-Specific Allowances

- Dentures and medically necessary dental work

- Prescription eyeglasses and vision care

- Prescribed hearing aids

Pro Tip: Always keep original receipts, invoices, and proof of payment. Expenses without proper documentation may not be approved.

Get the Answers and Protection You Deserve

If a loved one needs care and you have a home or other financial assets to protect, your first step should be calling Jarvis Law Office, P.C. We will crunch numbers and see how a straight spend-down can be avoided and how we can help you protect and preserve your hard-earned assets from having to be spent down.

At Jarvis Law Office, P.C., we’ve helped countless Ohio families qualify for Medicaid while protecting their homes, savings, and dignity.

Our flat-fee, hands-on approach means you get a custom strategy, clear instructions, and ongoing support, without surprise costs. We also coordinate with your existing financial advisor to protect your relationships and allow for continuity in your asset management.

Contact us today to get the answers you need and the protection you deserve.