When you’re caring for someone with special needs, one question often stands out clearly: How do I make sure they’re always cared for, even when I’m gone? A special needs trust offers a straightforward answer. It helps you set aside money safely, protecting your loved one’s access to essential programs like Medicaid and SSI.

According to the U.S. Census Bureau, approximately 44.1 million Americans, about 13.4% of the population, live with disabilities, many of whom could benefit significantly from having a special needs trust in place.

At Jarvis Law Office, we’ve guided many families through this process, helping them smoothly transfer their assets into trusts and avoid probate hassles along the way. With clear strategies for managing assets and a trusted team handling the details, you’ll have the support you need to secure your family’s future confidently.

Key Takeaways:

- Special Needs Trusts help protect your loved one’s eligibility for Medicaid and SSI by safely managing funds for their care.

- You can choose from three main types: first-party, third-party, or pooled trusts.

- Trusts cover important costs like education, therapy, and housing without affecting government benefits.

- Setting up a trust involves steps like selecting a trustee, funding the trust, and legally establishing it with professional guidance.

What is a Special Needs Trust?

A special needs trust (or supplemental needs trust) is a legal tool designed to protect assets for someone with a disability, without affecting their eligibility for government benefits like Medicaid or Supplemental Security Income (SSI).

If you’re caring for a loved one with special needs, this trust allows you to set aside money to pay for extra expenses, like therapy, education, or medical equipment, while preserving their eligibility for necessary public programs.

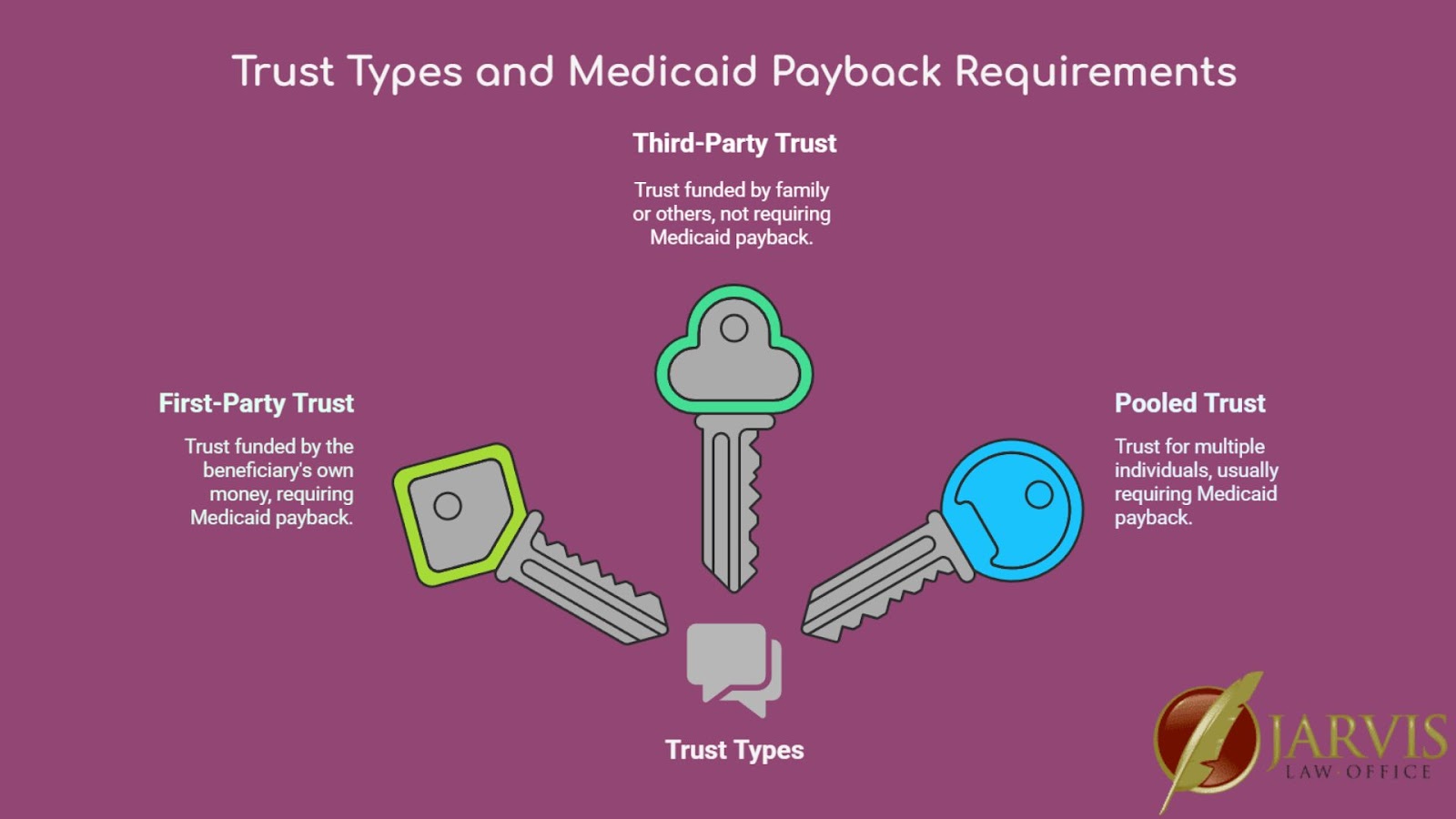

The 3 Types of Special Needs Trusts Explained

Special needs trusts come in three main types. Each one has different rules and is useful in different situations. Here’s a breakdown:

First-Party Trust (Self-Settled Trust)

A first-party trust is funded with money that already belongs to the person with special needs, often from an inheritance or legal settlement.

- Who Funds it? The beneficiary’s own assets.

- Important rule: When the beneficiary passes away, leftover funds usually go back to Medicaid as repayment.

Third-Party Trust

This is created using someone else’s money (often parents or relatives) specifically for the benefit of a person with disabilities.

- Who funds it? Family members or anyone besides the beneficiary.

- Key benefit: There’s no Medicaid repayment requirement, so leftover money can go to other family members or beneficiaries.

Pooled Trust

This trust combines funds from multiple beneficiaries into one large account, managed by a non-profit organization.

- Who should consider this? Families who prefer professional management or those with limited resources.

- Commonly used by: Families looking for a more affordable or convenient option.

How Can a Special Needs Trust Help My Child?

Setting up a special needs trust provides several important benefits, making life easier and more secure for both you and your child. Here are five key advantages you should consider:

1. Protects Government Benefits

One of the biggest advantages is that it protects your child’s eligibility for government programs like Medicaid, SSI, or housing support. Without this trust, your child could risk losing access to these benefits.

2. Covers Extra Expenses

A special needs trust can help pay for things government programs don’t cover, such as:

- Therapy sessions (physical, speech, occupational)

- Education and training programs

- Transportation and housing improvements

- Special equipment, like wheelchairs or computers

3. Provides Long-Term Financial Security

The trust makes sure your child will always have resources available, even if you’re not around to support them. It gives peace of mind, knowing they’ll be cared for long-term.

4. Prevents Misuse of Funds

You select a trustworthy person (a trustee) who will manage the funds responsibly and exclusively in your child’s best interests, protecting assets from misuse.

4. Flexibility in Managing Funds

You get to specify exactly how and when the trust’s money should be used, allowing you to tailor spending precisely to your child’s unique needs.

5. Improves Quality of Life

Overall, the trust makes it possible to cover necessary expenses that increase your child’s independence, comfort, and happiness, without risking important support programs.

Who is Eligible for a Special Needs Trust?

Your loved one is typically eligible if they have a disability recognized by Social Security or a government agency. Based on data from Medicaid.gov, approximately 80 million Americans rely on Medicaid for healthcare as of October 2024.

Eligibility for programs like Medicaid are strictly based on financial limits, currently set at just $2,000 in assets for an individual. This strict limit makes special needs trusts a vital tool for families who want to provide extra financial support without jeopardizing government benefits.

Eligibility Differences by Trust Type

Eligibility may vary depending on the type of trust:

- First-party trust: Beneficiary must be under age 65 and funding comes from their own assets (inheritance, settlement funds, etc.).

- Third-party trusts usually have fewer restrictions and can be established by parents or family members at any time.

- Pooled trusts are open to individuals with disabilities who want to combine their resources with others for professional management.

How Do I Set Up a Special Needs Trust? (Step-by-Step Guide)

Here’s how to set up a special needs trust:

Step 1: Decide Which Type of Trust Fits Your Family

First, decide if you need a first-party, third-party, or pooled trust based on your child’s financial situation and your goals. Most parents typically choose third-party trusts to avoid Medicaid repayment.

Step 2: Choose the Right Trustee

Pick someone trustworthy and responsible to manage the trust. This could be a family member, close friend, or a professional trustee. Many families opt for professional trustees, like banks or attorneys.

Step 3: Draft the Trust Document

With the help of an experienced attorney, write the trust document clearly outlining:

- Your child’s specific needs

- How the funds should be spent

- Instructions for the trustee

Step 4: Finalize and Legally Establish the Trust

Your attorney will draft the legal paperwork. After reviewing, you’ll sign and officially establish the trust, making it legally valid and enforceable.

The cost of creating a special needs trust generally ranges between $2,000 and $5,000. Considering the immense long-term value and protection these trusts provide, many families find this upfront cost to be a worthwhile investment.

Step 5: Fund the Trust

Decide how much money or assets you’ll put into the trust, and transfer them officially. This can be done immediately or later, depending on your plan. Professional trustees typically charge around 1% per year of the trust’s total assets to manage funds responsibly.

Step 6: Regularly Review and Manage the Trust

Once established, regularly review and adjust the trust to make sure it continues meeting your child’s evolving needs. Check in annually with your trustee or financial advisor.

Frequently Asked Questions About Special Needs Trusts

Q: Can a Special Needs Trust Pay for Housing?

Yes, a special needs trust can cover housing-related expenses, such as home modifications or utilities. However, paying rent or mortgage directly might affect SSI benefits, so consult a trust professional.

Q: How Much Does a Special Needs Trust Cost?

Initial setup typically ranges from $2,000 to $5,000, plus ongoing trustee fees of around 1%–2% per year, depending on how complicated it is.

Q: Who Should Manage a Special Needs Trust?

A trustee can be a family member, friend, or professional (lawyer or bank). Many families choose a professional trustee alongside someone who knows the beneficiary personally, allowing for better management.

Secure Your Loved One’s Future Today

A special needs trust gives your loved one lasting security and financial peace of mind. If you’re ready to move forward or still have questions, the dedicated team at Jarvis Law Office is here to help. We’ll simplify the setup process and help protect your family’s assets.

Reach out today to schedule a conversation with our team, you’ll leave feeling confident and clear about exactly what comes next.